Vert Global Sustainable Real Estate Fund (VGSRX)

Fund Commentary

September 30, 2023

| For the period ending September 30, 2023 | 1 Month | 3 Month | YTD | 1 Year | 3 Year | 5 Year | Since Inception 10/31/2017 |

|---|---|---|---|---|---|---|---|

| Vert Global Sustainable Real Estate Fund | -6.41% | -5.38% | -3.58% | 4.08% | 2.20% | -0.44% | -0.17% |

| S&P Global REIT Index | -6.61% | -6.49% | -4.54% | 2.03% | 2.21% | 0.01% | 0.66% |

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-740-VERT. Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Return figures over 1 Year are annualized. The fund Gross Expense Ratio is 0.67%. The fund Net Expense Ratio is 0.50% via expense limitation. Contractual fee waivers through October 31st, 2025. The net expense ratio applies to investors.

Third Quarter 2023 Update

- $129 million in net new assets year to date brings the Fund AUM to $292 million.

- The Fund will convert into an ETF structure on December 4th, 2023.

- In this quarter’s Spotlight we examine “The Shift to ETFs”.

Performance

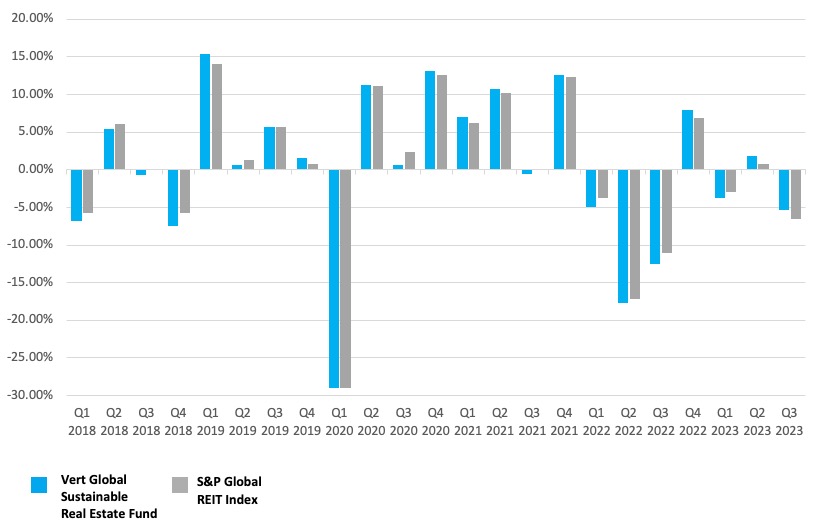

September was not a good month for REITs. Every sub-sector was down for the month except hotels and resorts, which managed a modest gain. The overall 6% drop in value brought both the 3rd quarter and YTD returns into negative territory. Volatility remains high as the market continues to react strongly to new information, particularly around interest rates.

The market seems to be undecided whether it likes good economic news currently. Normally, strong earnings and continued profits make for rising stock prices. These days, however, such news is often met with the fear of further interest rate hikes from the Fed. Thankfully, long term investors need not concern themselves too much with such short-term sentiments. As we’ve pointed out in previous Spotlights, REITs historically have done very well in times of high inflation and high interest rates. The same historical outperformance may not occur going forward in this next period of course. But it is a useful reminder that high inflation and high interest rates don’t necessarily result in low returns for REITS.

Fund Update

The Fund continues to attract new assets and new advisors. The year-to-date total of $129 million in net flows has raised assets under management to $292 million despite the downturn in prices.

As we head into the 4th quarter, Vert’s Investment Research Group begins our annual Re-Qualification process. This intensive research project examines all public REITs in our universe with updated environmental, social, and governance (ESG) data sets to determine which REITs deserve to be in the portfolio.

Fund to Convert to an ETF

The big news for the Fund is the upcoming conversion to an ETF structure. The conversion will start on Friday December 1st, 2023. By Monday December 4th, all existing fund shareholders will hold ETF shares. If an investor is holding the mutual fund on a brokerage platform that can hold ETFs, there is nothing investors or advisors need to do for the conversion. It is structured as a tax-free re-organization. The ETF ticker symbol will be VGSR. For more information on why we are converting, please read this quarter’s Spotlight, “The Shift to ETFs”, below.

Spotlight on “The Shift to ETFs”

The first Mutual Fund to ETF conversion occurred in early 2021. Guinness Atkinson converted two small mutual funds with just over $20 million in total assets. They were soon followed by Dimensional Fund Advisors with a much larger conversion of over $20 billion of their tax managed mutual funds. These pioneers cracked open the floodgates – just two years later over 50 mutual funds with over $60 billion in assets have converted to an ETF structure. Dimensional is the standout leader in re-organizations having now converted over $40 billion from the mutual fund to the ETF structure. Dimensional is the sub-advisor for the Vert Global Sustainable Real Estate Fund. Their experience, and successful track record, with these conversions is proving instructive in our Fund’s conversion to an ETF.

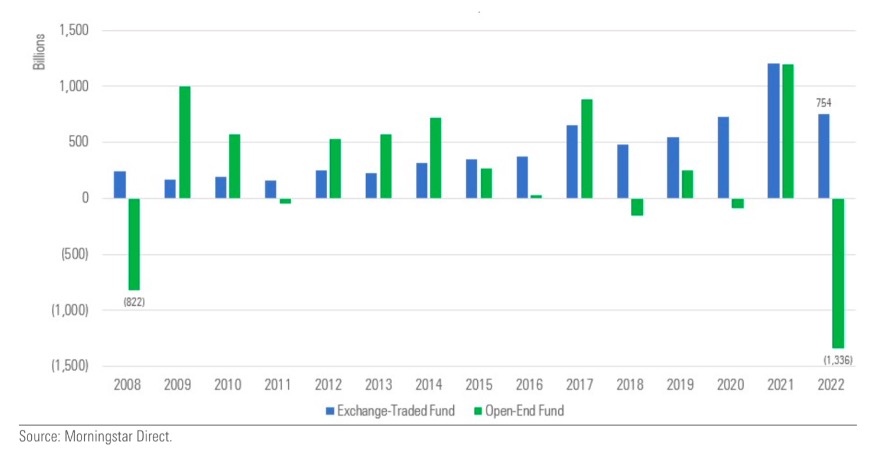

Vert will convert the Global Sustainable Real Estate Fund to an ETF on December 4th, 2023. We are doing this because many of our clients, almost all of which are financial advisors, now prefer the ETF structure. We polled a few dozen advisors that invest in the Fund, and with very few exceptions, most wanted us to convert the Fund to an ETF. This is reflective of a larger trend of a growing preference for ETFs for the past five years as detailed in this chart on mutual fund versus ETF flows from Morningstar.

Advisors prefer ETFs for their greater tax efficiency, lower ongoing expenses, lower transaction costs, and greater accessibility. We will look at these benefits individually, and what they mean for the Vert strategy specifically.

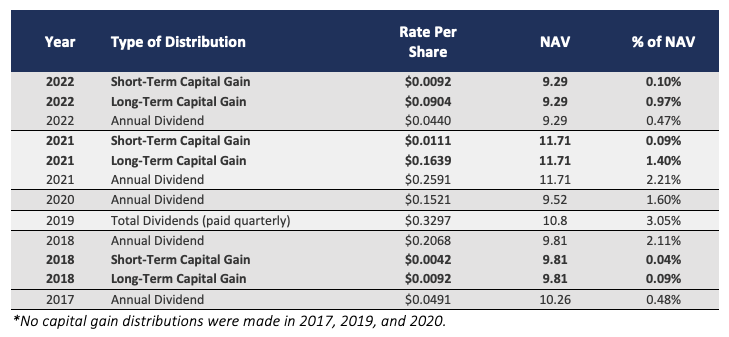

Greater Tax Efficiency. ETFs tend to distribute fewer capital gains than mutual funds. The way ETFs buy and sell securities, through a creation and redemption process with institutional investors, can eliminate many, and in some cases all, realized capital gains. Taxable investors find this advantageous. The ETF structure does not, however, reduce income distributions. In this area, mutual funds and ETFs are similar.

The Vert Global Sustainable Real Estate Fund has had the following distributions since inception. Capital gains have been distributed in three of the six calendar years so far and topped 1% of NAV in two years. To the extent the new ETF structure can reduce distributions, investors will see lower tax bills.

Lower Ongoing Expenses. ETFs can have fewer operating expenses than a mutual fund. Both are governed by similar regulations and share the requirements to have a Board of Trustees, auditors, a custodian, etc. But the ETF, since it is bought and sold on an exchange, requires less operational support in areas like transfer agency. Brokerage firms often charge asset managers substantial fees for mutual funds held on their platform. Many of these same brokerage platforms don’t charge these fees on ETFs.

Converting to an ETF makes it possible for us to lower the total expense ratio of the Vert Global Real Estate Fund from 0.50% to 0.45%. Our management fee remains 0.40%. We will limit the other expenses to 0.05% with a new expense limitation agreement.

Lower Transaction Costs. When investors buy or sell an institutional share class mutual fund on a brokerage platform, they are usually charged a transaction fee. These same brokerage platforms often offer free trading for stocks and ETFs.

The Vert Global Real Estate Fund has just an Institutional share class. Brokerage platforms ticket charges depend on what rates the advisor has managed to negotiate – but it is rarely zero. On the brokerage platforms that do offer free ETF trading, advisors can avoid those ticket charges going forward.

Greater Accessibility. Many brokerage platforms restrict the number of mutual funds they offer, but readily add ETFs. Some platforms have extensive due diligence requirements and expensive onboarding fees for funds. Almost all platforms require a legal agreement to add a mutual fund. Many of these same platforms have far lower hurdles for ETFs. Some other service providers, including model portfolio providers, TAMPs, etc. only work with ETFs. There are situations where ETFs are not an option, including in some 401k plans, but in general, ETFs are easier to access for many investors.

With a lot of hard work and expense, we got the Vert Global Sustainable Real Estate Fund on ten of the most popular platforms for advisors. But there were many more we did not get on. Our mission at Vert is to mainstream the adoption of sustainable investing. We believe this conversion to an ETF will give more investors the opportunity to invest for sustainability.

Given these benefits we believe the Vert Global Sustainable Real Estate Fund should be converted to an ETF. For most advisors and investors, it will be easier and cheaper to invest for sustainability in real estate than before.

DOWNLOAD

Explore more commentaries.

Please refer to the Prospectus for full risk disclosures. All data as of September 30, 2023 and subject to change daily.

ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a premium or discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact an ETF’s ability to sell its shares. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns.

Any tax information provided is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give tax advice.

The ETF has filed a registration statement with the Securities and Exchange Commission but it is not yet effective. An investment in the fund cannot be made, nor money accepted, until the registration statement is effective. An investor should consider the investment objectives, risks, and charges and expenses of the fund carefully before investing. A preliminary prospectus which contains this and other information about the fund may be obtained by calling 1-844-740-VERT. The information in the preliminary prospectus is not complete and may be changed. The final prospectus should be read carefully before investing, and when available may be obtained from the same source. This communication is not an offer to sell fund shares and is not soliciting an offer to buy fund shares in any state where the offer or sale is not permitted.

The Vert Global Sustainable Real Estate Fund and the Vert Global Sustainable Real Estate ETF is/will be distributed by Quasar Distributors, LLC. Vert and Dimensional are unaffiliated with Quasar Distributors.