Spotlight

REITs and Rising

Interest Rates

March 31, 2022

Interest Rates

REITs and Rising Interest Rates.

Fed officials recently said they would be raising their benchmark federal-funds rate. Most officials projected pushing the rate up to 2% by the end of 2022 and maybe even 2.75% by end of 2023. This would put rates back to where they were in 2008. Rising interest rates and expectations of future higher rates lead some to believe the real estate stocks are in for a difficult time. But research shows that REITs usually have positive returns, and often do well relative to the broader equity market in times of rising rates.

REIT Returns in Rising Rate Environments

The Fed normally raises rates to cool down a strong economy that is in danger of overheating, leading to inflation. Whether or not you believe the Fed is late this time, we are currently in this scenario.

Historically, there has generally been a positive correlation between rising rates and REIT returns. Strong economies create higher occupancy and higher rents, leading to more income and more profits for REITs. Property values also tend to rise in these environments, so REIT’s asset values go up.

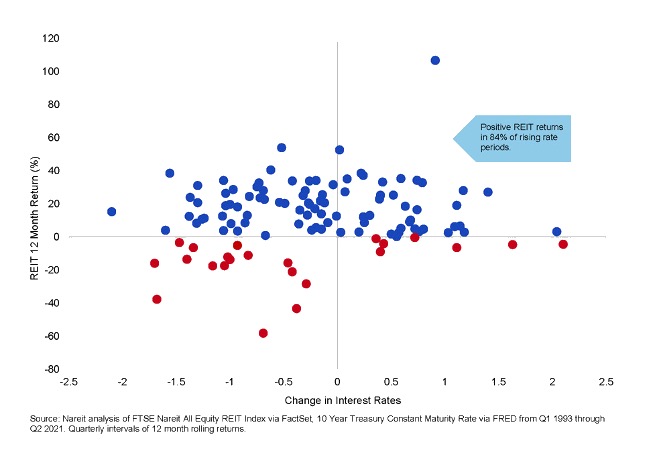

The chart below illustrates the relationship between the four-quarter change in the 10-year Treasury yield and the four-quarter total return on the FTSE Nareit All Equity REIT Index. REITs posted positive total returns in 84% of months with rising Treasury yield over the period Q1 1993 to Q2 2021.

Chart: REIT annual total returns were typically positive in months when interest rates were rising.

REITs have also done fine against broad equity indexes during many of these periods of rising interest rates. Over that same time period of 1993 to 2021, the FTSE Nareit All Equity REIT Index outperformed the S&P 500 in 48% of the episodes of rising Treasury yields.

REITs Exposure to Rising Rates

REITs have made substantive changes to the way they borrow that have made them more capable of handling higher interest rates. REITs have been slowly and steadily lowering their debt levels since 2008. The pandemic’s dramatic hit on asset prices lifted ratios a bit, but they are now back down about 50%. These lower debt levels decrease exposure to rate increases.

Lower debt also means less interest expense, and REITs are now enjoying historically low ratios of interest expense to net operating income (NOI). REITs paid about a third of their net operating income to debt service in the 00’s and early 10’s. Now interest expense for US equity REITs average just over a fifth of their NOI.

And finally, REITs have lengthened the maturities of their fixed debt as well. With the average maturity of their debt now at over 87 months, US REITs have locked in low interest payments for the next 7 years.

Investor Take-Away

The historical record on REIT returns in rising rate periods is broadly positive. REITs are even more insulated from rate increases than they have been in the past. A sensible investment strategy, as usual, is to stay the course, remain diversified, and maintain your asset allocation.

Please refer to the Prospectus for full risk disclosures. All data as of March 31, 2022 and subject to change daily.

One cannot invest directly in an index. Index performance is not indicative of the fund’s performance.

The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity Real Estate Investment Trusts.