2022 Annual ESG Report

Vert Asset Management

TABLE OF CONTENTS

OUR APPROACH TO ENGAGEMENT

OUR INVESTMENT PLATFORM

INVESTMENT STEWARDSHIP

INDUSTRY ADVOCACY

BUSINESS FOR GOOD

The Vert Global Sustainable Real Estate Strategy operated as a mutual fund from October 31, 2017 and prior to the fund reorganization on December 4, 2023. The investment objectives have not changed. The materials are shown for periods prior to the ETF listing date.

OUR APPROACH TO ENGAGEMENT:

Our Top 5 Ways to Drive Change

In 2022, the Vert Global Sustainable Real Estate Fund celebrated five years! We wanted to mark this achievement with a reflection on how we drive change in companies, financial services, and business owners.

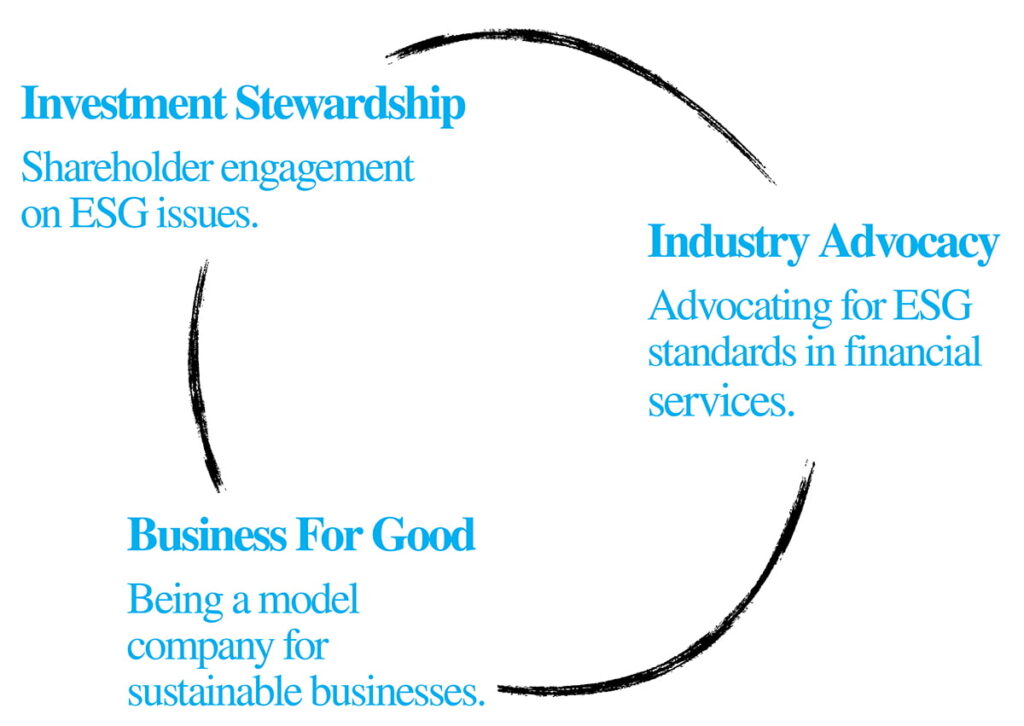

Engagement is three things (not one!)

Engagement does not start and stop with a shareholder proposal or a proxy vote. Engagement is about building capacity for change – at public companies, within financial services, and with ourselves as model company for sustainable business.

Communication is key.

Companies are made up of people. People learn through conversation. Our engagement approach is about education and influence.

Engagement complements the investment strategy.

We design our engagements in direct relationship to the environmental, social, and governance criteria that we invest with. We aim to match the systemic topics to our investor data needs.

Work with others.

Instead of the re-inventing the wheel we leverage the work others are already doing in areas that are aligned with our investment strategy and key performance criteria. Our stewardship efforts are focused on systems change.

Share stories.

Our website hosts highlights from our current and past engagement campaigns. Investors like to know that their fund managers are advocating for positive change. We try to make it easy by sharing these on our website.

DOWNLOAD

OUR APPROACH TO ENGAGEMENT:

2022 Highlights in Numbers

OUR APPROACH TO ENGAGEMENT:

Interdisciplinary & Inclusive

We are investors that want to see improvements in corporate behavior and more sustainability in financial services. We are also a company that wants to build our business practices to high standards. Vert practices engagement in three distinct ways:

These three lines of activity help us improve our understanding and positioning on environmental, social, and governance (ESG) issues from the interdependent perspectives of civil society, the public sector and the private sector.

OUR INVESTMENT PLATFORM:

Vert Global Sustainable Real Estate Fund

December 31, 2022

ESG

LEADERSHIP

The Vert Global Sustainable Real Estate Fund seeks to buy and hold only the publicly listed Real Estate Investment Trusts that are truly committed to sustainability.

The 142 companies in the Fund demonstrate leadership in one or more of the qualifying criteria* shown in the pie charts below. Environmental, social, and governance topics are often overlapping issues. Many companies qualify on more than one criteria.

*More information on the portfolio construction criteria is available in our strategy paper at “Investing for Sustainability: Real Estate”

https://www.vertasset.com/sustainable-real-estate/

Green Buildings

Share of buildings with a qualified green certification.

Water Reduction

Average reduction in water use and consumption.

Emissions Reductions

GHG emissions reduction that meet or exceed a decarbonization pathway by 2050.

Affordable Housing

Provision of below median market rate housing.

Urbanism

Share of portfolio near public transit options.

Diversity

Evidence of diversity in employee, management and executive teams.

Climate Policies

Verified policies, targets, or commitments to decarbonization.

Disclosure

Excellence in voluntary public reporting of ESG metrics.

Tenant Engagement

Initiating environmental and social goals tenants through green leasing.

LOW ESG

RISKS

We disqualify companies in specific business lines, that have significant controversies, and/or are inadequately prepared for climate risk.

INVESTMENT STEWARDSHIP:

Our Theory of Change

Collectively, we believe these efforts do provide companies with education on issues that investors care about and ultimately influence corporate behavior.We approach engagement from a “better business” perspective. We communicate with companies in the Fund on ESG issues that should enhance company operations and strategy.

We are recognized in the REIT community as an investment manager who is knowledgeable on ESG issues that are material to the real estate industry and the different real estate sectors. We want companies to understand that taking care of the triple bottom line – people, planet, and profit – is a successful way to run their business over the long-term.

Our theory of change hinges on building relationships with the companies that we invest in. We believe a successful investor and company relationship is a two way street: we can go to the company with suggestions and they can come to us for up-to-date resources and guidance. We influence through education.

Our umbrella campaigns are designed in close consultation with input from our investment research group, our previous engagement conversations, other asset managers, non-governmental organizations (NGOs), and participants in the real estate industry. Our main tools as investment stewards are direct dialogue and influencing public policy.

We start with direct dialogue. Each year we run an “umbrella” campaign where we communicate with every company in the fund on a critical ESG issue.

We collaborate with other asset managers and asset owners to reach out to companies on shared issue engagements.

We speak frequently at real estate industry events. We present Vert’s investment goals and represent the ESG investor community.

Collectively, we believe these efforts do provide companies with education on issues that investors care about and ultimately influence corporate behavior.

INVESTMENT STEWARDSHIP:

Systemic Approach

A systemic approach to investment stewardship requires the investor to look at the bigger picture. We are a relatively new entrant as an investment company and we are a small team. With these realities in mind, we have purposefully chosen to identify engagement topics that more than one company may be affected by. What are challenges that all companies are facing? We believe that climate risks inform business strategy and voluntary disclosures provide more useful non-financial data.

Climate strategy is a business strategy.

“Net-zero carbon pathways” are ways for businesses to reduce their operational and embodied carbon aligned with the goals of 2015 Paris Agreement. The Paris Agreement was a significant turning point because nearly all of the world’s countries (197 including the US) collectively acknowledged that humanity faces a singular threat – climate change. The accord commits countries to limit global temperature increases to below 2°C by 2050 by setting emissions reductions targets.1

At the national and local level laws and regulations have been passed to change behavior from the top-down. In the UK, for example, large companies are now required to report climate risk as recommended by the Task Force on Climate-related Financial Disclosures or TCFD-aligned disclosures. These disclosures help companies articulate to stakeholders how their corporate governance and business strategy considers physical and transition risks and opportunities.

Globally, physical assets and supply chains are facing increasing risks from climate change. The investment community is more closely evaluating the role of science based emissions reduction targets in corporate strategy to keep global warming to 1.5°C above pre-industrial levels. Investors are now asking tougher questions of companies and their net-zero plans. How are companies embedding climate risks and transitions risks into their overall corporate strategy?

Buildings consume 40% of the world’s energy and create 33% of global greenhouse gas emissions. Real estate owners including REITs can look at the transition to a low-carbon economy as an opportunity to foster innovation and outperform. We define “net-zero energy” or “net-zero carbon” as getting buildings to only consume as much energy as they procure from renewable sources. Buildings can achieve netzero through a combination of energy efficiency, electrification, and renewables procurement, and many can do so cost effectively.

[1] Since the Paris Agreement, the Intergovernmental Panel on Climate Change released additional research positing that industrial decarbonization targets must be below 1.5°C by 2040 in order to avert the worse case scenarios of climate change.

Voluntary disclosure and useful non-financial data.

Non-financial data is useful for better understanding how a company is accountable to various stakeholders. It is information that does not appear in the traditional financial reports that a company is required to produce or file with their regulators.

Voluntary disclosure frameworks such as the Global Reporting Initiative and the CDP (formerly the Carbon Disclosure Project) laid the groundwork for companies to evaluate their business activities from a multiple stakeholder perspective. These stakeholders are their employees, clients, suppliers, and the environmental resources. Companies now create materiality matrixes and publicly disclose internal and external initiatives with many stakeholders.

There are efforts to reconcile non-financial reporting with traditional financial reporting. The Sustainability Accounting Standards Board (SASB) which identifies material sustainability metrics in 77 industries is now part of the International Sustainability Standards Board (ISSB) under the guidance of the financial reporting standard setting body – the International Financial Reporting Standards (IFRS),

Non-financial reporting requirements for companies have made their way into European Union and UK legislation and regulation. Elements of CDP and TCFD form the basis for the US Securities and Exchange Commission’s proposed rulemaking for the inclusion of climate-disclosures in US companies’ annual financial filings.

INVESTMENT STEWARDSHIP:

Increase in Climate-related Disclosures

from Portfolio Companies

In our umbrella campaigns we focus on systemic challenges. A recent academic paper “The Impact of Sustainable Investing” describes ways in which stakeholders try to make companies more sustainable by influencing the fields in which the companies are embedded. Examples include: establishing reporting standards; influencing policy and regulation; development of tools, knowledge, and research; industry education, etc. Investors who practice field building are taking a systematic approach by trying to change the expectations and standards of behavior for all firms rather than one at a time.

For the real estate industry, climate-related disclosures are not only pervasive but they are also financially material. Over the last five years we have suggested ways that companies could increase investor awareness of their consideration of climate in their business strategy. We connect climate strategy to data disclosures.

2018 Greenhouse Gas Emissions

We engaged with companies on reporting like for-like emissions to an investor audience in 2018. We suggested to report to the Global Real Estate Sustainability (GRESB).

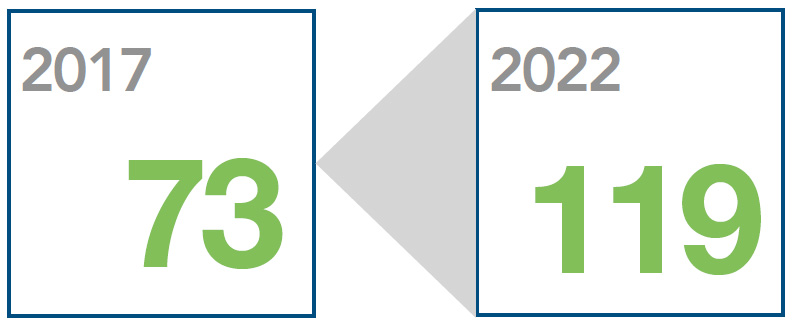

In 2017, there were 73 companies in VGSRX that reported to GRESB. In 2022, there are 119 companies that report to GRESB.

2019 TCFD &Climate Risks

We engaged with companies on integrating the recommendations of the Task Force on Climaterelated Financial Disclosures (TCFDs) and climate risks in 2019.

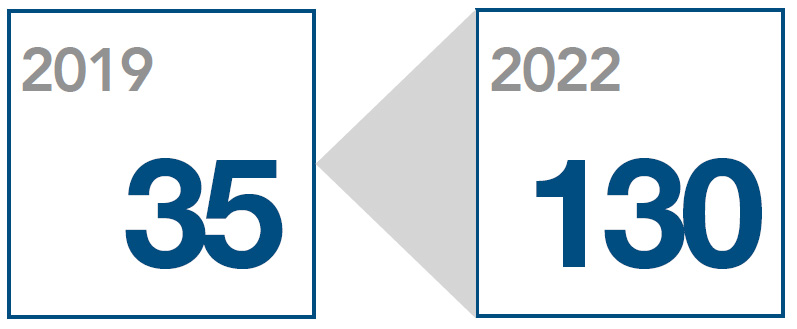

In 2019, there were 35 companies in VGSRX using the TCFDs. In 2022, there are 130 companies that use the TCFDs.

Note: In 2022, the UK made it mandatory that large publicly-traded companies file a TCFD report with their annual filings.

2020 Net Zero Pathways

We engaged with companies on net-zero pathways in 2020. One route we suggested was to develop science-based targets for emissions reductions and energy intensity.

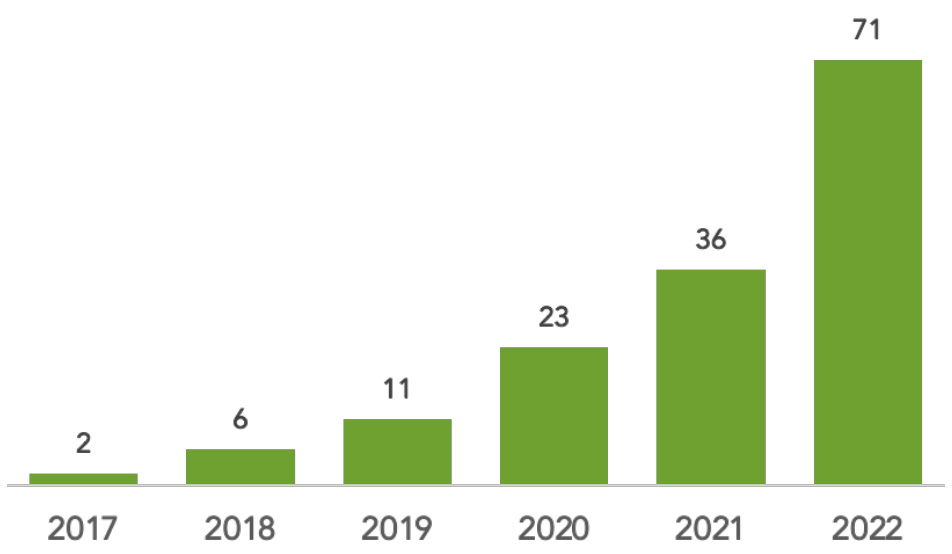

In 2022, there are 71 companies in VGSRX that have committed to the science-based targets initiative SBTi.

INVESTMENT STEWARDSHIP:

2022 Campaign: Operationalizing Decarbonization

We’ve found that resilience continues to be a common theme stakeholders are embedding in their long-term strategies. There is increased investors interest in decarbonization, customers (tenants) are looking to lower their carbon footprint, and regulators are embedding material climate risks into financial reporting.

In 2022, we revisited concepts from our 2020 campaign on net-zero pathways. We asked how companies are prioritizing stakeholder concerns around energy efficiency and emissions reduction into their long-term strategy:

- Can you update us on your decarbonization strategy and targets (i.e. net-zero pathways, a climate action plan, or science-based targets)?

- How are you reducing operational carbon across your portfolio (i.e. – Asset-level Sustainability Plans, Reduce Energy Use, Increase Renewable Energy Procurement, Building Electrification, Building Grid Integration)?

- How have the TCFDs (Taskforce on Climate-related Financial Disclosures) helped your company to consider business risks and opportunities from climate issues?

- Are there local regulations that are changing your company’s perspective on climate priorities over the long-term? (We adapted this question to the various regions that we invest. For the US, we asked how companies were planning to make use of the Inflation Reduction Act of 2022).

The questions solicit a dialogue and conversation. They encourage company teams to be strategic.

2022 Campaign in Numbers

- Letters Sent 138

- Responses Received 45

- Response Rate 33%

- Calls 34

Source: Storyset Illustrations. https://storyset.com/

INVESTMENT STEWARDSHIP:

Partnering for Net-Zero Carbon Pathways

Collaborative engagement is when we work with others in asset management to speak with companies on a specific topic. In 2021, we started a multi-year partnership with the Green Real Estate Engagement Network (GREEN). GREEN represents several Dutch Pension funds and global asset managers managing collectively over €2 trillion. They engage both listed and non-listed real estate owners on net-zero pathways.

Vert is collaborating with GREEN as an execution member by actively participating in the campaign to speak to the world’s largest 60 Real Estate Investment Trusts. The topic is not new to us as we had begun engaging with our entire portfolio on net-zero carbon pathways in 2020. From our conversations with companies in the years’ prior, it became clear that real estate will be directly and indirectly impacted by climate change. Physical and transition risks (and opportunities) due to the effects of climate change are not going away. Building owners are starting to factor in climate mitigation responses into their planned equipment replacement schedules as well as into their plans for more extensive retrofits.

Our conversations with real estate companies in collaboration with GREEN ask companies to consider making asset-level sustainability plans, consider developing science-based targets and to manage progress with tools such as the Carbon Risk Real Estate Monitor (CRREM). We also ask companies how they implement their plans (i.e internal carbon pricing for retrofits, asset-level sustainability plans).

| GREEN Campaign | 2021/22 | 2022/23 |

|---|---|---|

| Completed calls with companies held in VGSRX | 25 | 22 |

| Completed calls with companies not held in VGSRX | 7 | 3 |

GREEN’s research with with the real estate industry found more than half of larger REITs (by market cap) have set Science Based Targets for greenhouse gas emissions reductions. Even so, GREEN concluded that real estate owners can do more to demonstrate that their buildings’ are on a pathway to Paris-aligned goals through physical and transition risk disclosure.

INVESTMENT STEWARDSHIP:

Building Capacity in the Industry

Vert participates in several collaborations that leverage the network effects of the investment management industry and research expertise of non-governmental organizations. As ESG investors, we believe a climate strategy is a sustainable business strategy. Our participation is voluntary and we do not take collection action on investment decisions.

The three initiatives below are specifically to build capacity among companies for climate-related disclosures that investors are evaluating. We sponsor research on mapping ESG disclosures, encourage voluntary disclosure to known standards, and evaluate applicability of evolving disclosures.

Sponsor Research

Urban Land Institute (ULI) works with real estate companies, real estate investors, real estate researchers on practical applications and policy for the real estate industry.

In 2022 we continued work as founding sponsors of a real estate disclosure mapping project coordinated by ULI Europe.

Because of our expertise in real estate investment and past work on engagement, we also sit on the steering committee. The project seeks to map various data disclosure frameworks frequently used in real estate to simplify the process for real estate companies reporting into the capital markets. The final report was released in spring of 2023.

Encourage Voluntary Disclosure

CDP (formerly the Carbon Disclosure Project) helps companies and cities report their environmental impacts in emissions, waste, water, and forestry.

In 2022, we participated in the CDP Non-Disclosure Campaign for the third year. The CDP non-disclosure campaign asks companies who have not previously reported to CDP to start reporting to CDP.

In 2022, we continued to participate in their Science-Based Targets Campaign where CDP is contacting over 1800 companies requests these companies to commit and set a science-based target aligned with 1.5°C temperature scenarios.

We participated in both of these campaigns because we want to communicate the importance of environmental disclosure to all REITs.

Connect Investor Needs To Real Estate

IIGCC (The Institutional Investors Group on Climate Change) is the European membership body for investor collaboration on climate change.

We are a member of IIGCC real estate working group where we are regularly reviewing the connections between investor data needs, changing regulation, and what real estate owners can reasonably respond to.

INVESTMENT STEWARDSHIP:

Proxy Voting Summary

Proxy Voting is one piece of the engagement process. It is a requirement for US mutual funds. Our proxy voting policy reflects our concern for good corporate governance, environmental stewardship, and social well-being.

Vert Asset Management voted 1548 proposals at 147 meetings.

| Management Proposals | Number of Proposals | Votes For | Votes Against |

|---|---|---|---|

| Antitakeover Related | 25 | 98% | 0% |

| Capitalization | 160 | 79% | 7% |

| Board and Governance Related | 40 | 28% | 3% |

| Directors Elections | 794 | 89% | 6% |

| Compensation | 192 | 75% | 13% |

| Reorganization and Mergers | 33 | 100% | 0% |

| Routine Business | 291 | 88% | 2% |

| Shareholder Proposals | |||

| Directors Related | 11 | 0% | 9% |

| Labor Issues | 2 | 0% | 100% |

| Total Proposals | 1548 | 84% | 6% |

*Proxy voting period is for July 1, 2021 – June 30, 2022. Our Proxy Voting Policy and the NPX report is available at www.vertfunds.com

INDUSTRY ADVOCACY:

Our Partners

Vert participates in the advocacy of several working groups that are advancing policies addressing sustainability in business in general, in real estate and the financial services industry.

We are signatories to the Principles for Responsible Investment (PRI) – an international organization of asset owners and investment managers that have committed to 6 principles of integrating ESG into the investment process and creating awareness on ESG.

We are a member of The Forum for Sustainable and Responsible Investment (US SIF) – the US policy group that coordinates priorities from all types of investors on sustainable investing and helps get representatives in Washington, D.C to listen. Vert sits on the Education Committee.

We are affiliate members to ICCR (Interfaith Coalition for Corporate Responsibility) – a non-demoninational group that coordinates investment managers and asset owners to engage with companies on environmental, social, and governance issues.

We are supporters of the Task Force for Climate-Related Financial Disclosures (TCFD) – an international effort to normalize climate-related financial disclosures and make it common practices for companies.

We are investor members to the CDP (formerly Carbon Disclosure Project) – a global non-profit working to make “reporting a company’s carbon footprint” the norm across industries and sectors.

We are on a working group with The Climate Action 100+ – a coalition of large asset managers and asset owners led by CalPERS (the California Public Employees’ Retirement System) who are engaging over 100 companies that have been identified as the world’s largest carbon emitters.

We are investor members of the Global Real Estate Sustainability Benchmark (GRESB) – an industry association and data company that is advancing benchmarking and reporting of sustainability metrics in real estate.

We are signatories to the Finance for Biodiversity Pledge. It is a loose collaboration of asset owners and investment managers that are concerned with figuring out how financial institutions can standardize and account for biodiversity and ecosystem services in their investments.

We are execution members to the Green Real Estate Engagement Network (GREEN), a network of institutional investors, backed by leading sustainable real estate scientists and advisors to accelerate sustainability in the real estate sector with the goal to educate companies about financial and non-financial climate risks.

The Urban Land Institute (ULI) works with professionals within the real estate industry on new research and policy to support innovation. We are sponsoring and on the steering committee of research that the ULI Europe is coordinating to map various ESG disclosure frameworks.

We are members to IIGCC (The Institutional Investors Group on Climate Change) the European membership body for investor collaboration on climate change. The organization’s mission is to support the investment community to commit to and make progress towards a net-zero future. We are a member of their property working group.

We are members of The Net Zero Asset Managers Initiative. The purpose of the initiative is to support asset managers who are interested in reducing emissions in the real economy and their portfolios.

We are a Certified B Corp. There are now 4000+ Certified B Corps globally. The B Lab, a non-profit, manages the certification process works with companies and non-governmental organizations to encourage companies to improve practices is the areas of governance, customers, community, and environment.

We are supporters of SME Climate Hub which supports small to medium sized companies to explore pathways to net-zero by 2030.

INDUSTRY ADVOCACY:

Our Policy Initiatives

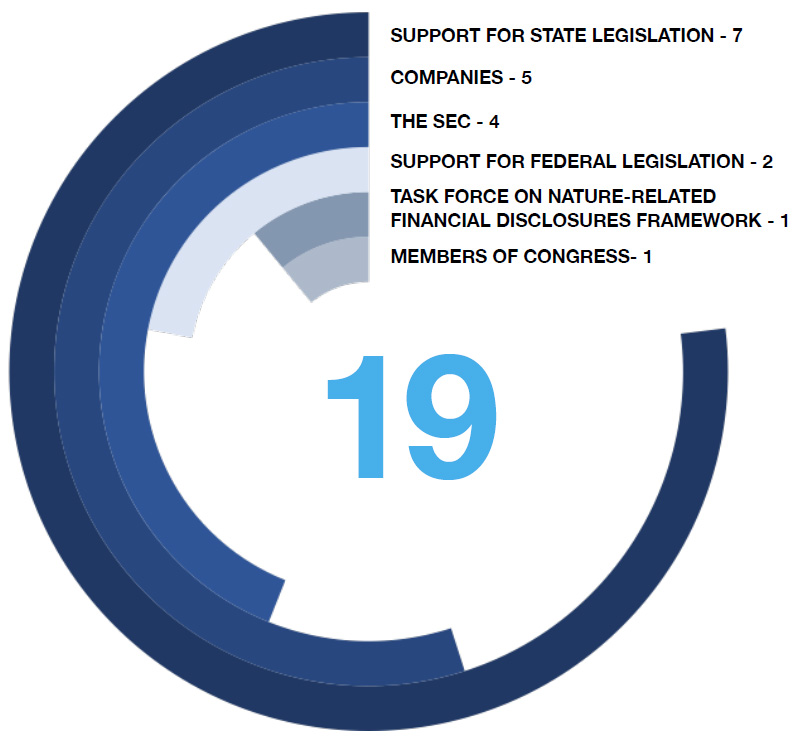

As an advocate for ESG disclosures in financial services, we call, meet and write to our elected representatives and regulatory institutions.

We coordinate with other organizations and asset managers on select environment, social and governance campaigns to bring a unified front to companies, networks, and government agencies.

In 2022, we contributed to 18 communications to different audiences detailed in the chart to the right. Below are some highlights from our advocacy work organized by theme.

Transition

to a Low Carbon

Economy

Met with Senate and House of Representatives’ elected officials to educate on the importance of clean energy at the federal level and how provisions in the Inflation Reduction Bill could help. This outreach was organized by Ceres’s LEAD programming.

Supported California state proposed bill SB 449 Stern on Climate Risk Disclosures (i.e. TCFD aligned disclosures).

Voiced concern with the California Public Utility Commission’s (CPUC) decision to revise California’s net metering program for solar installations.

Supported state-level Advance Clean Fleets and Advance Clean Car regulations in California.

Sustainable

Reporting and

Transparency

Communicated with real estate investment trusts on behalf of CDP for disclosing corporate emissions.

Submitted comments to the SEC’s on three proposed rule-making items including: Climate-related Disclosures for Investors, ESG disclosures for investment companies, and investment company names.

Encouraged Asia-Pacific REITs to respond to the Global Real Estate Sustainability Benchmark (GRESB).

INDUSTRY ADVOCACY:

Building Capacity for Sustainability with Regulators

In 2022, the SEC issued three rule-making proposals concerned with climate and sustainability topics. We contributed to the public comment period for each. Below is a short summary of each proposed rule and our perspective.

SEC

The Enhancement and

Standardization of

Climate-Related

Disclosures for Investors

File No. S7-10-22

The rule proposes: extensive climate-related financial disclosures for companies. The proposal is largely based on the TCFD framework. It asks companies to disclose greenhouse gas emissions using the GHG Protocol conventions of Scope 1, Scope 2, and Scope 3. It would require companies to explain their decarbonization process if they have these goals.

Vert’s perspective: We support many aspects of the rule especially the guiding framework based on the recommendations of the Task Force on Climate- related Financial Disclosures (TCFDs). We agree with requiring companies to explain company decarbonization goals and use of internal carbon pricing. We would like to see a reporting requirement for disclosing Scopes 1 and 2 emissions and Scope 3 emissions (with safe harbors and/or voluntary). We are also interested in companies disclosing climate-related physical and transition risks in a standardized way.

SEC

ESG Disclosures for

Investment Advisors and

Investment Companies

File No. S7-17-22

The rule proposes: three distinct categories to clarify to investors to what extent are investment funds are taking environmental, social, and governance issues into consideration in the investment process.

Vert’s perspective: We support the rationale that investors should be provided with information that helps them understand the environmental, social and governance considerations included in a fund. However, the current proposed categories in this “ESG Disclosures” (File S7-17-22) create more confusion than clarity for investors.

SEC

Investment

Company Names

File No. S7-16-22

The rule proposes: to expand the Names Rule’s 80% investment policy to include funds with names that include terms suggesting the fund focuses on particular investment strategies.

Vert’s perspective: We support the SEC efforts to clarify fund names and minimize the use of misleading or deceptive fund names. We believe that the descriptions of the terms used in the fund name must be consistent with those terms in “plain English” meaning or established industry use.

INDUSTRY ADVOCACY:

Education & Influence

Vert’s Build It Bootcamps.

We educate financial advisors on sustainable investing.

Understanding ESG, SRI, and Impact Investing

Building Sustainable Portfolios

Stakeholder Approach to Sustainable Business

In 2022, we continued to iterate our Build It Bootcamps. We now offer topics from the Bootcamp curriculum as one-off interactive workshops to select of groups of investors.

In partnership with Dimensional Fund Advisors and Evidence-Based Investment Portfolios, Vert has taught the benefits of sustainable investing to over 2000 financial advisors in the US, UK and Australia.

We also teach on the US SIF Fundamentals Course and Kaplan’s Chartered SRI Counselor Course. Both courses are designed for financial services professionals. Kaplan provides a designation after successfully completing an exam.

We provide practical tools for financial advisors who are interested in incorporating sustainable investing into their practice.

In 2022, Your Essential Guide to Sustainable Investing: How to Live Your Values and Achieve Your Financial Goals with ESG, SRI, and Impact Investing hit the bookshelves. Renowned American economist Burton Malkiel contributed the foreword to the book, written by coauthors Larry Swedroe and Vert’s CEO Sam Adams.

The authors cut through the fog and bring clarity on what sustainable investing is, who is currently investing this way and why. They review the evidence on the performance of sustainable investing and how it influences corporate behavior. The book also includes a practical guide to selecting investments for a robust and sustainable investment portfolio.

The book was published by Harriman House and released April 5, 2022.

The book is available to financial advisors to add their own forward and logo. It is truly a tool to grow their business.

BUSINESS FOR GOOD:

Being a Model for Sustainable Business

We endeavor to show leadership on how to run a business with sustainability at the center of our mission. We became a Certified B Corp to signal to our clients and others that we are dedicated to managing and operating our business in an ethical and sustainable way. The B Corp certification is rapidly becoming the global standard for sustainable business.

B Corps are leading a global movement to redefine success in business – that businesses can be successful and do good at the same time. By voluntarily meeting higher standards of transparency, accountability and performance, B Corps are distinguishing themselves in a cluttered marketplace by offering a better way to do business.

Here are some ways we’re making a difference:

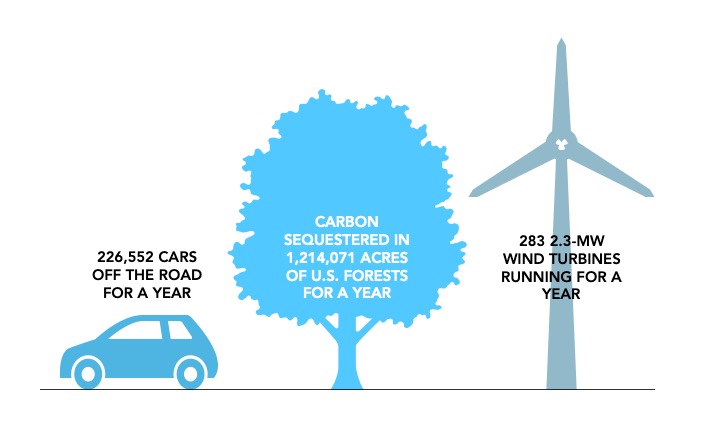

Carbon Footprinting

We have measured our carbon footprint to understand how we can design for less. As a service business, our carbon footprint is mostly the energy purchased for our office (Scope 2) and business travel (Scope 3). We do not have any Scope 1 emissions. We follow currently accepted best practice which is to reduce emissions as much as possible, and then purchase Carbon

Offsets for the residual emissions that we cannot eliminate. See our carbon reporting in our TCFD report on p. 20.

Flex-Time

Flex-time has been a reality for us since day one. Modern work life has evolved from being chained to your desk with your boss looking over your shoulder from 9-to-5. We’ve found we do

better work when there is balance – working to deadlines, but having the freedom to stay home with a sick child.

Education

We are interested in building capacity for ESG in financial services. This means providing and participating in educational opportunities. We are on the US SIF Education Committee. We

teach on the USSIF Fundamentals of Sustainable Investing Course. We teach the Kaplan’s Chartered SRI Counselor course. We also guest-lecture at universities.

Sam co-authored a book Your Essential Guide to Sustainable Investing.

Internship Program

In the 2021/2022 academic year, we started an internship program for undergraduate students. We designed the role to introduce students to macro-sustainability issues and connect it to how

companies are taking action. The program is specifically for those students who are working and cannot easily get the experience in sustainability that they need to advance in this field. In the 2022/203 academic year, we welcomed 6 interns.

Our 2022 diversity metrics.

| Vert Diversity Metrics | Ownership | Executive Team | Advisory Board | Interns |

|---|---|---|---|---|

| % Women | 49% | 66% | 0% | 57% |

| % Underrepresented | 1% | 0% | 33% | 28% |

As part of this commitment we joined 1% For The Planet, a foundation started by Yvon Chouinard, the founder of Patagonia. Member companies pledge 1% of their before-tax revenue to the foundation which then donates to its network of ‘green’ charities. It is important that business is seen as a force for good.

BUSINESS FOR GOOD:

Our 2022 TCFD Report

The TCFD asks companies to report on climate risks as it relates to their business strategy. In 2018, we formally endorsed the TCFDs. In 2019, we engaged our portfolio companies on the TCFDs. Additionally, the PRI asked for volunteer reporting to the Task Force on Climate-related Financial Disclosures (TCFD) questions on their annual questionnaire. In 2020, we created our first TCFD Report.

Our 2022 TCFD report covers our approach to the operational resilience of our business as well as the climate risk of our investment products.

Governance

Board oversight of climate-related risks and opportunities

Climate-related risks and opportunities are governed by our founders. Sustainability and transition to a low-carbon economy underpins our investment products, education services, and engagement efforts.

We do not have a formal board, but our Advisory Board includes a thought-leader on sustainability, an academic expert in finance, and a financial industry veteran. Management confers with these experts regularly.

Management’s role in assessing and managing climaterelated risks and opportunities

Senior Management implements a firm-wide strategy to identify climate-related risks across the business and its services.

The CEO leads the Investment Research Group, which designs the investment strategy and selects securities. The CEO is also part of the portfolio management team to provide additional oversight for climate-related issues.

Strategy

Climate-related risks and opportunities over short, medium and long term

Short term 1-3 Years

Rapidly evolving demand for climate-risk products and financial services regulatory oversight covering ESG products.

Medium term 3-7 years

Higher temperatures, drought, and extreme weather events will change the way risks are managed.

Long term 7-15 years

Decarbonizing the economy will increase demand for different types of investment products.

Impact of climaterelated risks and opportunities on the organization’s businesses, strategy, and financial planning

Our approach to building investment products recognizes climate change and decarbonization. 100% of our strategies incorporate energy transition concepts and we exclude the fossil fuel companies in our real estate strategy. We engage our portfolio companies on climate-related risks including responses to TCFD, adaptation and mitigation plans, and net-zero pathways.

Our business operations are currently operating at a minimum threshold. We calculate our Scope 1, Scope 2, and Scope 3 (business travel) energy use. We have revised our position on voluntary offsets, and are no longer participating.

Resilience of organization’s strategy considering different climate-related scenarios

Our strategy allows our investment approach and our business operations to respond with agility to climate-risks. We are regularly updating our risk assessments as climate change scenarios are updated.

We have assessed our investment product through the 2 Degrees Investing Initiative scenario analysis tool PACTA (Paris Agreement Transition Assessment). The results confirmed our own analyses that an investment will suffer losses if portfolio companies does not integrate climaterisk mitigation strategies.

Risk Management

Processes for identifying, assessing and managing climaterelated risks and integration of those processes into overall business risk management

Our process for identifying climate-related risks is part of our investment strategy and portfolio construction process. We evaluate a company’s raw data on emissions reduction over a 5 year

period. We also evaluate their climate change policies and adaption strategies and whether they have adopted a net-zero pathway. We also engage companies on their climate risks such as sea-level rise, flood, heat stress, water stress, and extreme weather.

We monitor and comply with all applicable laws and standards.

We participate in industry groups to monitor and understand emerging “best practices”. We joined B Corp Climate Collective and SME Hub to ensure we were working on the next iteration of requirements for a service business.

Metrics and Targets

Metrics used to assess climate-related risks and opportunities in line with strategy and risk management processes

In our investment strategy, we use a company’s annual emissions over the past 5 years, their decarbonization goals and their exposure and mitigation efforts to physical climate risk.

We also engage companies on their climate issues including climate risks, TCFD, science based targets, and planning for net-zero goals.

In our business operations, we strive for operational efficiency in our energy use and we prioritize video meetings over air travel to in-person meetings.

Disclosure of Scope 1, 2, and if appropriate Scope 3 and related risks

We are committed to voluntarily gathering and reporting our Scope 1, Scope 2, and Scope 3 emissions. We began offsetting our residual emissions in 2019 with verified carbon offset projects through Cool Effect. However, we have revised our position on voluntary offsets, and are no longer participating. Our company is operating at a very low emissions threshold.

Our financed emissions (Scope 3) represent the majority of the emissions for our company. In 2021, we formalized our commitment to track the emissions of companies in our mutual fund.

Carbon Footprint

| GHG emissions in Metric Tonnes CO2 Equivalents | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Scope 1 refers direct emissions created by assets owned by the company. | 0 | 0 | 0 | 0 | 0 | 0 |

| Scope 2 is for indirect emissions i.e. purchased energy for office use. | 4 | 4 | 4 | 4 | 5 | 5 |

| Scope 3 is for indirect emissions created in the supply chain and by any asset not owned by the company i.e. business travel and commuting. This figure does not include emissions of companies within our investment portfolio. | 25.16 | 17.31 | 12 | 5.32* | 2.5* | 4.85 |

| Total GHG Emissions | 29.16 | 21.31 | 16 | 9.32 | 7.5 | 9.85 |

Targets used by the organization to manage climate-related risks and opportunities and performance against targets

Our targets are to 1) use our investment platform to communicate to our stakeholders the importance of climate-change and the transition to a low-carbon economy, 2) build education materials to communicate to financial intermediaries the demand for sustainable investing, 3) to use our own operations as a lab to better understand the challenges we are asking of our portfolio companies.

*Scope 3 emissions category 6 business travel is not reflective of normal travel demands in years prior to the pandemic. We expect that as conferences return to in-person these Scope 3 emissions will increase to pre-pandemic levels.

Annual Engagement Campaign Review

2018 Greenhouse Gas Emissions Reporting

Our first engagement focused on introducing companies to the Vert Global Sustainable Real Estate Fund, our investment philosophy, and what we are looking for in public disclosures. We wanted to let firms know that there was a dedicated ESG mutual fund that was investing in real estate on sustainability criteria. We wrote to companies about the importance of disclosing year-onyear comparable greenhouse gas emissions. We conveyed the importance of standardized investor ready data on emissions reported directly from companies to the capital markets.

2018 Campaign in Numbers

- Letters Sent 98

- Responses Received 29

- Response Rate 30%

- Calls 11

2019 Climate Resilience and Task Force on Climate-related Financial Disclosures (TCFDs)

Our second engagement asked companies to consider using the framework for evaluating climate risks called the Task Force on Climate-related Financial Disclosures. We believed that the investment community was coalescing around TCFD. The TCFD is intended to collate existing data (i.e. GRESB, CDP, management discussion and analysis) to understand physical risks to the company due to climate change. TCFD also asks companies to perform climate change scenario analysis in conjunction with a company’s financial analysis to determine specific risks and opportunities for the company.

2019 Campaign in Numbers

- Letters Sent 123

- Responses Received 60

- Response Rate 49%

- Calls 30

2020 Net-Zero Pathways

Our third engagement built on our previous GHG emissions reporting and TCFD campaigns by asking companies to disclose their targets for emissions reductions, and also their plans to achieve them. Globally, physical assets and supply chains are facing increasing risks from climate change. The investment community at large is more closely evaluating the role of science based emissions reduction targets in corporate strategy to keep global warming to 1.5°C above pre-industrial levels.

2020 Campaign in Numbers

- Letters Sent 132

- Responses Received 55

- Response Rate 42%

- Calls 29

INVESTMENT STEWARDSHIP:

2021 Campaign: Healthy Buildings

Covid-19 reinforced the need for ‘resilience’ in real estate. The pandemic made it increasingly difficult to ignore the interconnectedness of climate, social, and economic risks to the long-term health of business. We have seen leading organizations evolve their corporate strategy to include a more comprehensive set of ESG metrics. These same organizations are looking for answers to address the new normal.

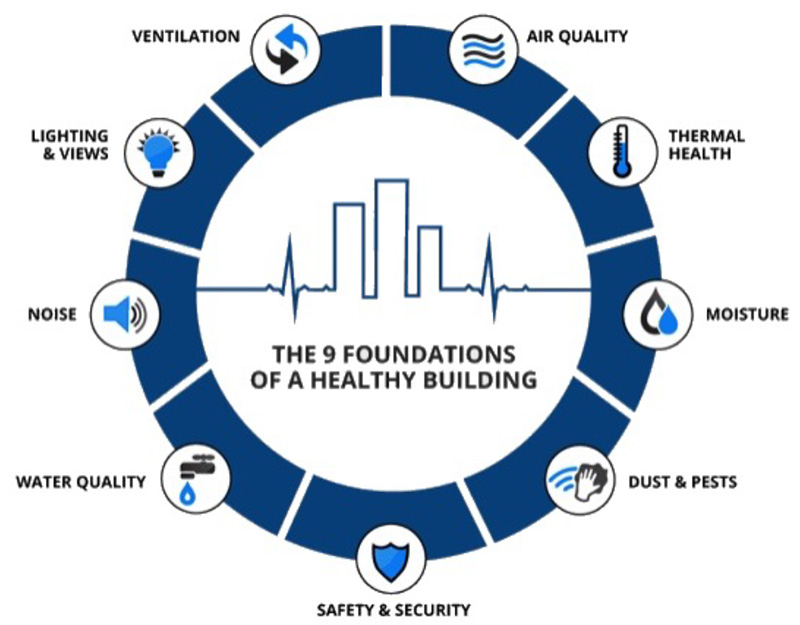

People spend 90% of their time indoors, however indoor environmental quality is often overlooked. Covid has focused occupant attention on these spaces and accelerated interest in health and well-being in buildings. A luxury two years ago, many owners now consider healthy buildings a must have; and a way to reassure tenants’ of their safety and well-being inside buildings.

Professor Joe Allen’s book, Healthy Buildings, identifies the nine foundations of a healthy building —ventilation, air quality, health, moisture, dust and pests, safety and security, water quality, noise, lighting and views. They are derived from 40 years of scientific evidence on the factors that drive better health and performance for a buildings’ occupants.

Additionally, recent research suggests that creating walkable environments with greenspace is associated with reduced risk of chronic disease, viral infection and mortality.1

[1] Frank LD, Wali B. Treating two pandemics for the price of one: Chronic and infectious disease impacts of the built and natural environment. Sustainable Cities and Society. 2021

Jun 12. 73:103089. DOI: 10.1016/j.scs.2021.103089.

2021 Campaign

Healthy Buildings

In 2021, we asked companies a series of questions around healthy buildings and biodiversity. 34% engaged in direct dialogue with us on healthy buildings. We asked companies’ how they were accounting for healthy building features in their strategies.

- Do you use certifications such as with WELL or Fitwel to communicate healthy buildings features to your stakeholders?

- Are you finding that there are trade-offs between energy efficiency and ensuring a well-ventilated building?

- What percentage of your portfolio is in a walkable or urban location well-connected to transit?

- To what extent have you considered adding green spaces, outdoor access, and biodiversity to your buildings?

We also asked our portfolio companies to participate in a healthy buildings academic research survey. We coordinated with a PhD student under the supervision of one of the academics on the Vert Investment Research Group, Professor Franz Fuerst of the University of Cambridge.

The research project aims to better understand which investments in green and healthy buildings generate financial returns for the property owners.

2021 Campaign in Numbers

- Letters Sent 106*

- Responses Received 37

- Response Rate 34%

- Calls 11

Sustainable Development Goals in the Real Estate Industry

The Sustainable Development Goals (or the SDGs) are the next iteration of UN goals that bring multi-stakeholder awareness to a multitude of challenges facing our world including ending

poverty, protecting the planet, ensuring peace and prosperity. The 17 goals require the coordination of civil society, governments and the world economy.1

The modern concept of sustainable development in the UN framework started with the Bruntland Report “Our Common Future” for the World Commission on the Environment and Development in 1987. The report was commissioned to highlight the interconnectedness of society, institutions, business and the economy in balancing economic and ecological demands. The report broadly defined sustainable development as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”2 Sustainable development at the UN has further evolved to clarify that each country has differentiated responsibilities in respect to achieving a prosperous economic and ecological balance.

The SDGs are the result of the UN recognizing that sustainable development cannot happen through government regulation alone, but requires the efficiency of businesses and capital allocation of the economy.

The SDGs dove-tail with the Paris Agreement in 2015 wherein countries committed to differentiated responsibilities to limit global carbon emissions. The SDGs came into effect on January 1, 2016 and will guide international policy-making decisions through 2030.

The World Green Building Council illustrates how 9 of 17 SDGs are linked to buildings and real estate. Buildings consume 40% of the world’s energy. We spend 90% of our lives indoors. The built environment has an outsized influence on our overall well-being.

Sustainable Development Goals and Our Investment Strategy

The Investment Strategy connects to the SDGs in two principal ways:

- Our Key Performance Indicators (KPIs) focus on material ESG issues in real estate. These issues map to three primary SDGs (9, 11, 13). We select companies doing well on these and then we engage with them to do even better.

- Our KPIs demand more disclosure and more data. We work directly with researchers and data providers to build new datasets to surface corporate behavior tackling the SDGs.

Ultimately, the SDGs are national goals. SDGs are systems-level which are comprehensive in their nature meaning success on one will involve tackling issues associated with another. It is forcing investors to think more holistically and to connect investing to a broader context.*

We have mapped our key performance indicators directly to 3 primary SDGs in the table below:

Sustainable Development Goals

9 Industry Innovation and Infrastructure:

Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation. Companies can upgrade local infrastructure, invest in resilient energy, and in communications technologies.

11 Sustainable Cities and Communities:

13 Climate Action:

Take urgent action to combat climate change and its impacts. Companies can decarbonize their operations and supply chains by improving energy efficiency, reducing the carbon footprint of their products, services and processes, and setting emissions reductions targets.

Sustainable Development Goals

Qualifying ESG Criteria

- Emissions Reduction

- Green Buildings Certifications

- Green Leasing

- Urbanism

- Stakeholder Engagement

- Affordable Housing

- Diversity

- Disclosures

- Corporate Climate Policies

Disqualifying ESG Criteria

- Controversies

- Business Line

- Climate Risk

1 Sustainable Development Knowledge Platform (2018). “Transforming our world: the 2030 Agenda for Sustainable Development.” Accessed at: https://sustainabledevelopment.un.org/post2015/transformingourworld

2 UN World Commission on Environment and Development (1987).”Our Common Future”. Oxford: Oxford University Press. Accessed at: http://www.un-documents.net/ocf-ov.htm#1.2

*Learn more on how business can support the SDGs at https://sdgcompass.org.