Vert Global Sustainable Real Estate Fund (VGSRX)

Fund Commentary

September 30, 2022

| For the period ending September 30, 2022 | 1 Month | 3 Month | YTD | 1 Year | 3 Year | Since Inception 10/31/2017 |

|---|---|---|---|---|---|---|

| Vert Global Sustainable Real Estate Fund | -13.30% | -12.58% | -31.63% | -23.02% | -6.08% | -1.01% |

| S&P Global REIT Index | -12.73% | -11.12% | -29.23% | -20.49% | -5.20% | 0.39% |

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-740-VERT. Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Return figures over 1 Year are annualized. The fund Gross Expense Ratio is 0.67%. The fund Net Expense Ratio is 0.50% via expense limitation. Contractual fee waivers through October 31st, 2025. The net expense ratio applies to investors.

Third Quarter 2022 Update

- The Fund drops 12.58% in the third quarter, making this the third straight quarter of decline.

- Fund investors remain resilient, with positive fund flows continuing.

- This quarter’s Spotlight looks at “How Sustainable Investing Has Evolved in the Past Five Years”

Fund Update & Performance

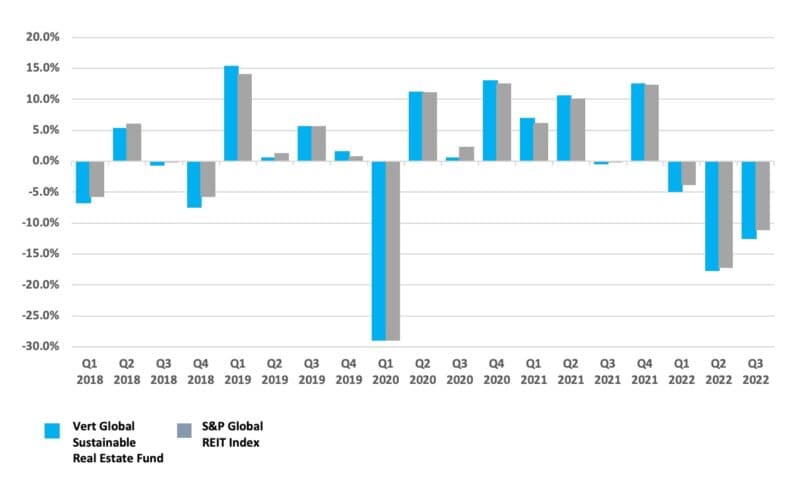

Public real estate has had a tough third quarter, like most equities. The S&P Global REIT Index finished the quarter with a -11.12% return and the Fund followed with -12.58%.

It is hard to find solace when markets are down 30% year to date. But real estate investors might want to remember last year, 2021, when the Fund returned 32.6%. The pendulum seems to be swinging with extra amplitude of late. This volatility is unsettling but it doesn’t change our investment strategy. We still believe staying invested is the most prudent course of action. And our investors seem to agree.

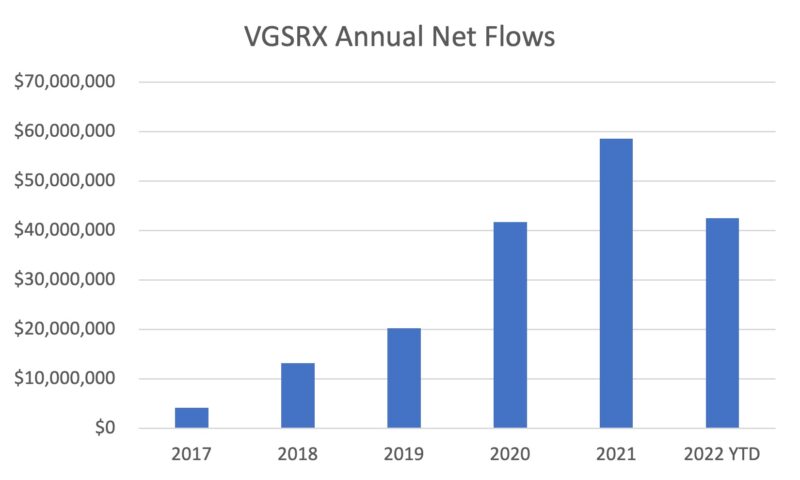

Net flows to the fund remain strongly positive and were $17.8 million in the second quarter, taking the total raised year to date to $42.5 million. Assets in the fund still dropped due to the market downturn, and ended the quarter at $155 million.

On October 31, 2022 the Fund celebrates its 5th Anniversary. We would like to thank our advisor clients for their continued and consistent support. Despite very volatile market conditions, the Fund has enjoyed steady and growing positive inflows since inception. Over 150 financial advisor firms and more than 50 401(k) plans have invested in the Fund.

Spotlight on “How Sustainable Investing Has Evolved in Five Years”

Environmental, social, and governance (ESG) investing, being a relatively new discipline, evolves rapidly. The Vert Global Sustainable Real Estate Fund launched in late 2017, and in the ensuing five years, much has changed in sustainable investing, in real estate, and in capital markets. More investors are moving capital to sustainable strategies than ever before, there is more and better ESG data available, and more real estate companies are committing to sustainability. Here are five ways that sustainable investing has changed in the past five years.

1. Rapid Growth in ESG Investing

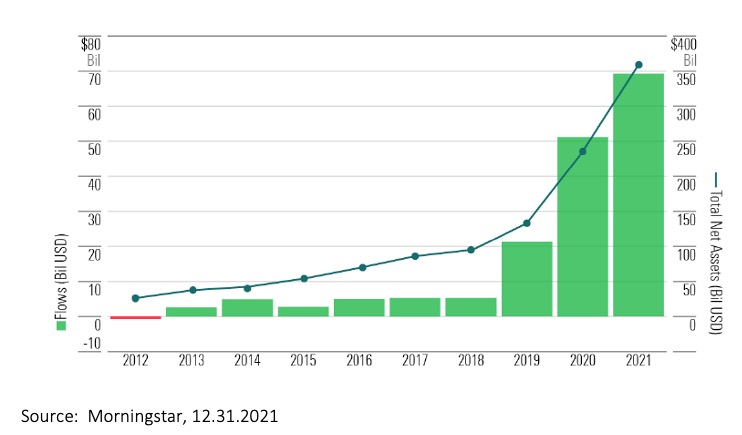

Five years ago, ESG investing was still confined to the largest institutional investors and a relatively small group of committed individual investors and wealth managers. Flows to ESG funds in the US were under $10 billion a year, and it was rare to see an ESG article in the press, or in a panel discussion at a conference. When we told people we were launching an ESG mutual fund, we got some quizzical looks. Few mainstream investors thought ESG would ever be more than a niche.

Then flows into ESG jumped to $20 billion 2019, $50 billion in 2020, and almost $70 billion in 2021. Fund managers rushed to launch products to capture the interest, and there are now over 500 ESG funds and ETFs on offer in the US. It’s hard to find a conference without an ESG panel, and there are multiple ESG articles in the media every day.

The landscape of investment management has permanently changed. The increased client demand and cash flows have driven more ESG product launches. Research teams and portfolio managers with these mandates have generated unprecedented demand for more ESG data.

2. ESG Data Explosion

Listed companies have responded to the demand for more ESG reporting. Non-profit environmental disclosure platform CDP said more than 18,700 companies —worth a combined $60.8 trillion— disclosed data on climate change, deforestation and water security in 2022. The number of companies reporting is almost triple that of 2017, when 6,300 companies submitted.

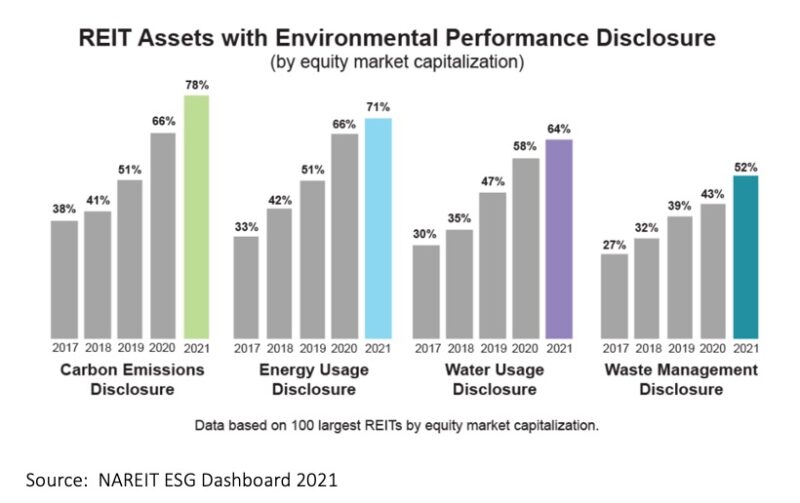

The story is similar within the Real Estate sector. Only about one third of US REITs were reporting ESG metrics in 2017. Now over two thirds are. This is excellent progress and has changed our ability to help distinguish leaders from laggards. We have a better picture of what REITs are doing around sustainability, but there is still need for improvement. We don’t have the standardization and robustness on ESG data that we enjoy for financial data.

It is often said that what is measured gets managed. Companies often follow up on their disclosures with efforts for better performance. And in the past five years, we’ve seen many firms take the next step by making commitments and setting targets.

3. Net Zero

In 2015, I went to Paris to participate in the Sustainable Innovation Forum, a side event of COP 21. I remember talking to people who were promoting the idea of aligning investment portfolios along ‘pathways’ to keep global warming to 1.5 degrees. To be honest, I thought it would never take off. But in 2020 the Net Zero Asset Managers Initiative launched and asked investment managers to support “the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 degrees Celsius”. As of 2022, 273 signatories representing over $61 trillion have signed up. Vert signed on in April 2021.

It’s not just the investment managers making these commitments. There are now Net Zero groups for Asset Owners, Bankers, and Insurers. The finance community has recognized their role as capital providers, and is getting on board.

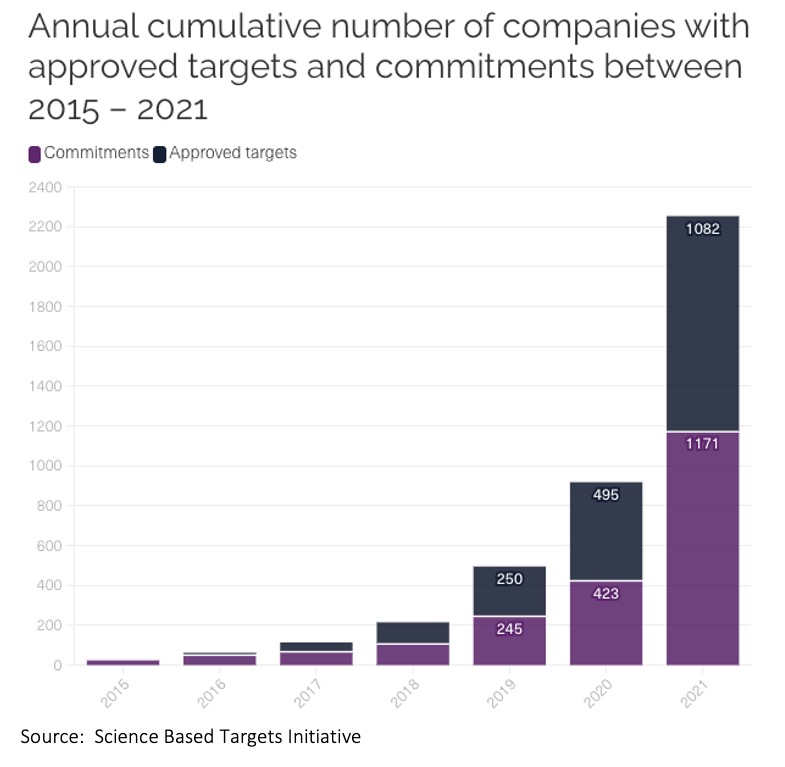

Critically, so are companies. In 2015 the Science Based Targets Initiative (SBTi) launched to assess company commitments to Net Zero. At the end of 2021, over 2,200 companies were working with SBTi. We can certainly debate on how serious these commitments are and whether companies will reach them. But 5 years ago, very few companies were even talking about Net Zero.

In the real estate sector, 192 companies have committed to SBTi. Many of these firms are committing to net zero because they see a future where their prospective tenants will demand the buildings they occupy won’t add to their carbon footprint, because they are on a decarbonization pathway themselves.

In the Vert Global Sustainable Real Estate Fund 54 REITs are working with SBTi. And SBTi is by no means the only framework. For example, 14 REITs have made a similar climate commitment by joining the RE100, a group of companies dedicated to procuring 100% of their energy from renewables. Still others have set targets or commitments with other groups or on their own.

4. Climate Risk

Five years ago, most of the people talking about climate risks were scientists and policy wonks. In fact, it was in 2017, that the Task Force for Climate Related Financial Disclosures (TCFD) first released climate-related financial disclosure recommendations to help companies report. For a while we all got the acronym wrong so often– was it TFCD or TCFD again? – that it was a running joke, much like forgetting the mute button on Zoom calls is now.

TCFD eventually came to be well known. And we are proud to have been a part of that. Our 2019 engagement campaign asked every company in our portfolio what they planned to do about reporting climate risks and if they were going to adhere to the TCFD recommendations. We had many calls with companies to explain to them what it was. One company, a large healthcare REIT, thanked us for the education, and then proceeded to implement the recommendations in their next annual ESG report. And they probably are glad they did. Today, the TCFD is a requirement for UK listed companies, and it is the blueprint for the SEC’s proposed climate disclosures (see last quarter’s Spotlight).

While companies were figuring out how to disclose, climate scientists began publishing new data on the physical risks of climate change. These new datasets could estimate the sea level rise for any coastal location. Others could pinpoint where the risk of flooding from rivers and rainfall was greatest. Scientists modeled which locations would face extreme heat days, droughts and wildfires. Initially this data was only available for geographical locations, so it wasn’t particularly easy to use by investors. After all, real estate companies often have dozens, if not hundreds or thousands of properties.

To solve this problem, Vert brought together one of these new climate research firms, 427 (since purchased by Moody’s) and a real estate data firm, GeoPhy (since purchased by Walker & Dunlop), to create the world’s first climate risk database for REITs. We began using this data in 2018 to screen out firms that were both heavily exposed to or not preparing their properties for extreme climate risk.

5. The Rise of S

Historically, many ESG strategies focused more on environmental issues. Social issues were seen as less material, more subjective, and hard to quantify. Several events have occurred in the past five years that has placed more attention on social issues. In 2018 the Time’s Up movement was launched in response to the expose’ of film producer Harvey Weinstein and sexual harassment more broadly. The George Floyd murder in 2020 galvanized many to protest racism. And, of course we all experienced the Covid-19 pandemic.

These unfortunate events have reshaped the conversation about social risks. Companies have begun to re-evaluate how they treat their employees, customers, suppliers, and their communities. Many companies have concluded they must do more to be proactive in keeping people safe, and championing diversity, equity, and inclusion.

Covid has changed the real estate industry dramatically, and permanently. The pandemic’s very sudden, and intense, focus on health brought forward some of the improvements buildings have needed for a long time. Certification programs like ‘Well’ and ‘Fitwell’, that honored buildings for their health and wellbeing features had been around for some time. But they weren’t popular – most building owners did the minimum the codes required for air quality and cleanliness and non-toxic materials. The pandemic made health issue number one and suddenly wellbeing went from a luxury to a must have. In fact, we made Health and Wellbeing the centerpiece of our 2021 Engagement Campaign.

Here at Vert we have been comforted by the fact that many of the companies in the portfolio took leadership roles in responding to these crises. We saw that these leaders were making positive impacts, often with little cost, and less fanfare. We will keep pushing companies to measure and report their social metrics so that progress for people goes hand in hand with progress for the planet.

DOWNLOAD

Explore more commentaries.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to change.

Please refer to the Prospectus for full risk disclosures. All data as of September 30, 2022 and subject to change daily.

The Vert Global Sustainable Real Estate Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory, and if available summary prospectuses contain this and other important information about the investment company, and may be obtained by calling 1-844-740-VERT or visiting www.vertfunds.com. Read carefully before investing.

Mutual fund investments involve risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. A REIT’s share price may decline because of adverse developments affecting the real estate industry. REITs may be subject to special tax rules and may not qualify for favorable federal tax treatment which could have adverse tax consequences. The Fund’s focus on sustainability may limit the number of investment opportunities available to the fund and at time the fund may underperform funds that are not subject to similar investment considerations. Diversification does not assure a profit or protect against loss in a declining market.

The S&P Global REIT Index is drawn from constituents in the S&P Global Property Index. Constituents must conform to the legal structures that define a real estate investment trust in the U.S., or similar guidelines in the country of their domicile. The REITs in the index are primarily companies that invest in buildings, which are human occupied or used for storage. The REIT indices specifically exclude timber REITs, mortgage REITs and mortgage-backed REITs. One cannot invest directly in an index.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services

The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity Real Estate Investment Trusts.

The Vert Global Sustainable Real Estate Fund is distributed by Quasar Distributors, LLC.