Spotlight

The State of ESG Reporting

in Real Estate

December 31, 2021

in Real Estate

The State of ESG Reporting in Real Estate.

The growth in environmental, social, and governance (ESG) investing over the past several years is astounding. Global flows to sustainable funds and exchange-traded funds (ETFs) have topped $100 billion for each quarter in 2021, reported by Morningstar. According to The Forum for Sustainable and Responsible Investment (US SIF), the assets invested using ESG criteria now totals $17 trillion, or 1 of every 3 professionally managed dollars. These flows have a huge effect on the investment management industry. Fund managers launched hundreds of ESG ETFs and mutual funds. Most major asset managers now offer ESG choices.

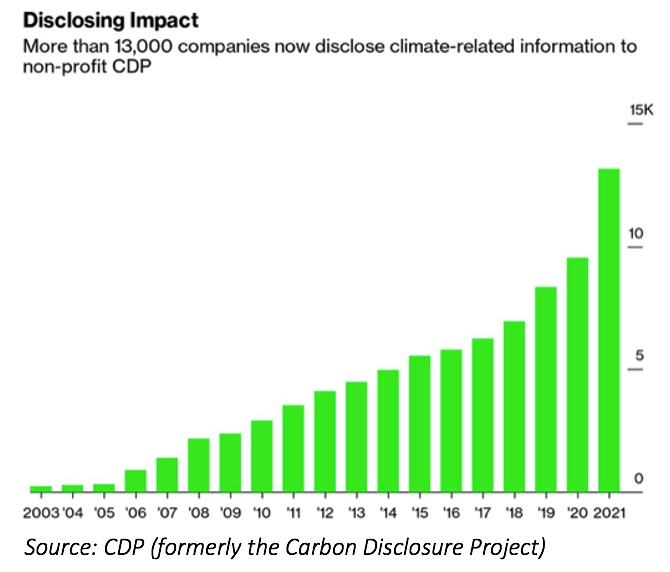

Investors, both professional and individual, are clearly allocating more assets to sustainability funds. A reasonable question is, are companies responding? Are they operating more sustainably than before? Undoubtedly. More companies are reporting their sustainability performance and more are committing to action than ever before. In 2021, over 13,000 companies disclosed climate-related information to the non-profit CDP (formerly the Carbon Disclosure Project), almost double the number of reporters in 2017. Chart 1 shows the trend toward more disclosure and increased transparency is clear.

Chart 1: Increasing in companies disclosing to CDP

The real estate sector is responsible for over 30% of the world’s greenhouse gas (GHG) emissions, 12% of water use, and 40% of waste. As such, it is critical that real estate companies measure and manage their impact. How are they doing?

When we launched the Vert Global Sustainable Real Estate Fund in late 2017, ESG data on REITs was difficult to find. The real estate sector was considered by many to be a laggard as only a minority of companies reported ESG performance . No longer. An incredible coalition of leading REITs, industry associations, and researchers have collaborated to rapidly advance the quantity and quality of ESG reporting. Companies voluntarily reporting to the Global Real Estate Sustainability Benchmark (GRESB) in 2021 number over 1,500. In 2017, it was only 850 firms.

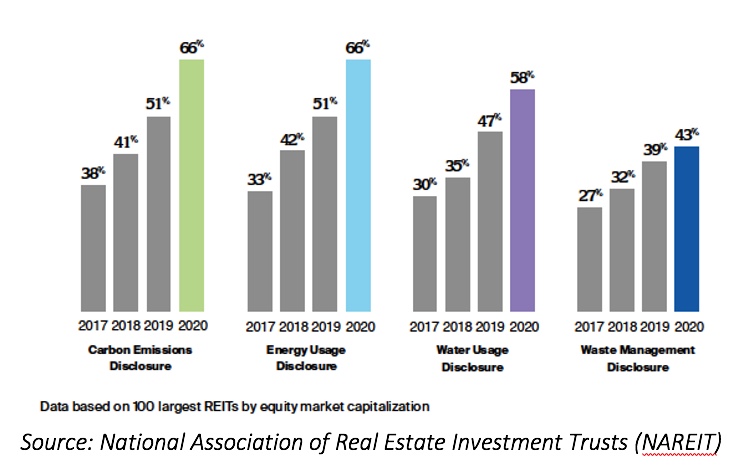

There is rapid progress in the US, with the majority of larger REITs now actively and voluntarily disclosing ESG performance. The National Association of Real Estate Investment Trusts (NAREIT), the industry body for REITs in the US, publishes an annual ESG report highlighting the progress REITs are making. Chart 2 below shows the increase climate metrics that companies report.

Chart 2: NAREIT members increase reporting on climate metrics 2017-2020

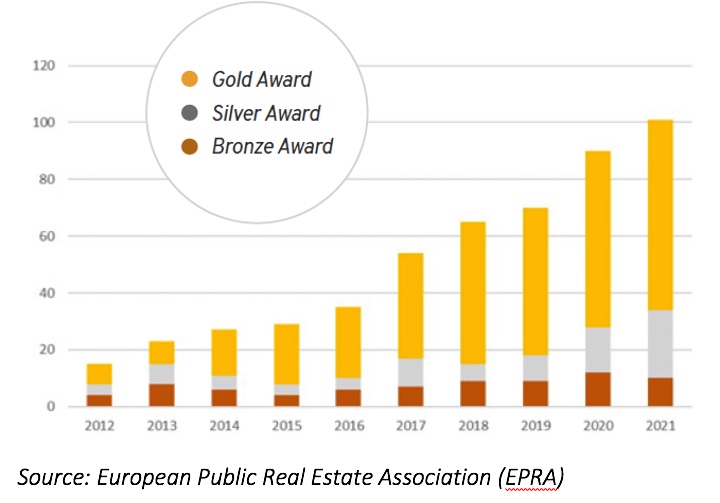

Europe is the leader in ESG disclosure. Collectively the European Union (EU) and the United Kingdom (UK) continues to set the standard, with more companies than not achieving high marks for reporting. 2021 marks the 10th Anniversary of the European Public Real Estate Association’s (EPRA) Sustainability Best Practices Recommendations. Every year EPRA awards companies based on adherence to their reporting standards. Companies scoring above 85% get a Gold Award, those scoring between 70-85% receive Silver, and 60-69% obtain a Bronze Award. In 2021, 102 companies, or 62% of EPRA members, received an award, up from only 18% in 2012. The chart shows most companies receive the Gold Award.

Chart 3: EPRA recognize more companies in Gold Award category

Europe is the leader in ESG disclosure. Collectively the European Union (EU) and the United Kingdom (UK) continues to set the standard, with more companies than not achieving high marks for reporting. 2021 marks the 10th Anniversary of the European Public Real Estate Association’s (EPRA) Sustainability Best Practices Recommendations. Every year EPRA awards companies based on adherence to their reporting standards. Companies scoring above 85% get a Gold Award, those scoring between 70-85% receive Silver, and 60-69% obtain a Bronze Award. In 2021, 102 companies, or 62% of EPRA members, received an award, up from only 18% in 2012. The chart shows most companies receive the Gold Award.

The explosion in quantity and quality of ESG data in real estate increases our, the fund manager, capabilities to discern which companies are committed to sustainability. Questions about how committed companies are remain, and greenwashing is certainly a growing concern. The increase in disclosures makes it easier to communicate with companies about their ESG goals.

Investors, and investment managers, have an important role to play in encouraging corporate ESG reporting. Not only should they be asking for more reporting, they should ask for better reporting. Reporting is the central focus in our Engagement Strategy since our Fund launched. Each year we write to every company we hold and ask them to improve their disclosure. Past campaigns focus on the following:

- 2018: Standardize year-on-year reporting of company Greenhouse Gas Emissions.

- 2019: Report company Climate Risks according to the Task Force for Climate Related Financial Reporting (TCFD).

- 2020: Clarify and detail the company’s Net Zero strategy.

- 2021: Disclose the company’s Healthy Buildings certifications.

We also communicate with other stakeholders on improving disclosures. Some examples include petitioning the SEC on ESG disclosures in regulatory filings and asking real estate industry advocacy organizations such as NAREIT and EPRA to improve member diversity disclosures.

Please refer to the Prospectus for full risk disclosures. All data as of December 31, 2021 and subject to change daily.