Spotlight

What to Make of the ESG Backlash?

March 31, 2023

What to Make of the ESG Backlash?

Readers of the financial press will probably have read about a backlash to ESG. From the volume of articles published it might seem the movement to sustainable investing is stalling. This is a false conclusion.

These articles usually point out that ESG funds, after a long run of above average performance, turned in a relatively poor 2022. They often add that prominent politicians have chosen ESG as their new villain in the culture wars. And they invariably point out that flows to ESG funds shrunk in 2022. Readers are led to believe investors are turning against ESG for one or all of these reasons.

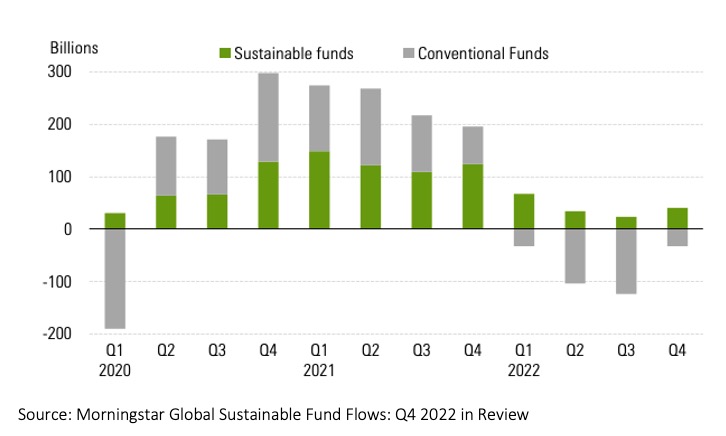

Even the most cursory of examinations reveals this narrative to be problematic. Flows to ESG funds in the US did drop from $70 billion in 2021 to only $3 billion in 2022. But flows to conventional funds in the US were negative $370 billion in 2022. So, if investors were running from anything, it was conventional investing, not ESG. Below is a chart showing quarterly flows to sustainable and conventional funds aggregated across the globe.

There certainly are issues with ESG investing, and some criticisms have merit. In particular, greenwashing remains a problem and ESG data isn’t as robust and standardized as traditional financial data. These issues are being addressed and will take further work and debate. However, the recent political critiques against ESG are nothing but a distraction. Complaints about ESG come from both the far right and the far left end of the political spectrum. These political attacks, from both corners, have a faulty diagnosis of the problem, and a cure that is worse than the illness.

The "ESG does nothing" Argument

A few critics say that ESG does not do any good at all. Some go further and claim it’s harmful. Tariq Fancy, a former Blackrock employee, wrote a series of articles in 2021 that claimed ESG is actually counterproductive because it is distracting us from real progress that can only be made with government intervention. Often ascribed to the far left, these arguments are rooted in an ideology that capitalism is the problem and should not be part of the solution. ESG is certainly not a panacea, and we will need strong government policies to help combat issues like climate change and income inequality. But ignoring the power of markets and placing all the burden on policymakers does not accurately reflect how change happens in the US. There are thousands of companies currently committed to sustainability. We need their innovations, their capabilities to scale solutions, and the market’s rapid adjustments to prices in order to make sufficient progress.

The "ESG is too powerful" Argument

Some politicians in the US are now calling ESG the bogeyman and have launched legal and policy initiatives to curb the use of ESG in investment portfolios. These agitators on the far right claim ESG is an attempt to force companies to adopt the far left’s progressive, liberal, and ‘woke’ agenda. And if left unchecked, ESG will limit corporate profits and leave America without enough energy.

In 2021, Texas enacted a “Boycott Bill” for the state’s public investments. The law precludes the state treasurers’ office from using investment managers that are divesting from the fossil fuel industry. Texas has placed 11 asset managers onto this list. Another dozen states have introduced bills or issued “state investment policies” to expressly prohibit the explicit consideration of environmental, social or governance criteria in the states’ public investments. A few of these initiatives have been passed, but more have been rejected, most recently by Arizona and Wyoming. Some of these states’ own research has predicted such moves may result in higher expenses and lower performance, thereby costing their citizens billions of dollars.

On a national level, Congress put forth legislation to block a recent Department of Labor (DOL) guidance on ESG investing in pension plans. Biden promptly vetoed it and for good reason. The DOL guidance that the Republicans took issue with simply allows retirement plans to consider ESG issues if they are financially material. The legislation was passed with the rallying cry that plans were being forced to consider ESG issues that were not material. A simple reading of the DOL guidance clears this misconception away.

A Cure Worse Than the Illness

Both attacks from the left and right, strangely enough, dismiss the power of markets and information. Perhaps the pundits have forgotten their history lessons. Capitalism, as has been said, might not be the best economic system, but it is better than all the alternatives.

The idea that ESG is a distraction and that government policy is the only tool we should use to change corporate behavior ignores basic common sense. Companies are owned by investors and regulated by governments. If we want companies to behave more sustainably, it seems clear we employ the power of ownership to encourage it.

Texas placed Blackrock on their boycott list because Blackrock offer a few funds with no fossil fuel investments. But Blackrock, as the largest fund manager in the world, has nearly $260 billion invested in fossil fuel companies around the world, including $91 billion in Texas. If Texas wants to protect their fossil fuel industry, boycotting the firm that owns 9% of Philips 66 and Occidental Petroleum; 8% of Valero Energy and ConocoPhillips; and 6% of ExxonMobil doesn’t make much sense. This blatant contradiction reveals these antics are clearly for political drama.

The DOL Rule is written very clearly – it allows pension plans to consider ESG when it is financially material. It does not require managers to use ESG. Passing legislation to restrict investment choice hardly seems consistent with the free market approach Republicans have historically favored.

It is easy to criticize ESG. It is a relatively new investment discipline – the term was only coined in 2005. It is not the distraction nor the bogeyman that it has been made out to be.

There is a Difference Between ESG versus SRI

Much of the blame for these anti-ESG attacks belongs to our hyper-partisan political system. But the investment management industry is at fault as well. As interest in sustainable investing has grown, fund managers have too often chosen terminology for marketing reasons rather than for accuracy. This lack of discipline in the use of terms for sustainable investing has created confusion about what ESG actually is and what it isn’t.

There are forms of values-based investing where you can push an agenda, but that isn’t ESG. We call that SRI or socially responsible investing. SRI investors have historically divested from companies they don’t like, and invested in those they do. Some SRI investors shun guns, others embrace them. Some funds avoid so called ‘sin stocks’ like alcohol and tobacco but other funds are explicitly investing in these firms. SRI is custom to whatever the investor wants so it can be conservative or progressive or religious or deeply personal. Unfortunately, ESG has become a catchall term for all forms of values-based investing. This lazy and inaccurate definition creates confusion for investors, and leaves an opening for attacks from all sides.

A more accurate description of ESG would help both investors and politicians understand it better. ESG is an investment process that examines the risks to companies arising from their environmental footprints, their social impacts, and their governance practices. ESG data can illuminate which firms pollute more, which have labor issues, and which have inadequate risk controls. This is why more and more of the largest investors around the world are embracing ESG.

- 12 of the 15 largest pension funds in the world employ ESG.

- 75% of Sovereign Wealth Funds use ESG.

- 47% of Central Banks integrate ESG.

These investors are hungry for any additional information that helps them better assess risk. You need not be a sustainable investor to want this information – even conventional investors want a fuller risk picture.

Recognizing this, the SEC will soon publish guidance on new climate risk disclosure requirements for public companies. The proposed rules released in 2022 require companies to report their Greenhouse Gas Emissions and their exposure to climate risk. Climate change risk is real and therefore a concern for all investors, whether sustainably minded or not.

The political rhetoric in the United States is overheated enough. It doesn’t need more fuel to burn, and we would be wise to keep investment strategies out of the fire. We certainly don’t want politics deciding how we can and should invest. Our time would be better spent on improving ESG data, combatting greenwashing, and handling our fiduciary duties with care.

Please refer to the Prospectus for full risk disclosures. All data as of March 31, 2023 and subject to change daily.