Fund Strategy

Money Talks. Speak Up.®

Fund Presentation

Sam Adams, CEO, reviews the Vert Global Sustainable Real Estate Fund in the short presentation above.

Engagement Review

Sarah Adams, Chief Sustainability Officer, reviews engagement in the short presentation above.

The Vert Global Sustainable Real Estate Strategy operated as a mutual fund from October 31, 2017 and prior to the fund reorganization on December 4, 2023. The investment objectives have not changed. The fund presentation and engagement review shown are for periods prior to the ETF listing date.

Investment Objective

The Vert Global Sustainable Real Estate ETF (VGSR) seeks to achieve long-term capital appreciation.

Investment Strategy

Vert’s investment process is rooted in the results of academic research on sustainability in real estate. Our evidence-based approach focuses on the metrics within environmental, social and governance (ESG) criteria that research has shown to be most material for real estate companies. We evaluate companies based on Key Performance Indicators most relevant to their particular business within the real estate sector. Only companies with a demonstrated commitment to sustainability qualify for the portfolio. Companies that have a history of controversy, are inadequately prepared for climate risks, or that operate in certain business lines, are disqualified.

We use a long term buy and hold strategy and maximize diversification to try to lower uncompensated risks. Companies are held at approximately market cap weights to reduce turnover. The fund is sub-advised by Dimensional Fund Advisors LP, who bring over 35 years of experience in efficient portfolio management and trading.

| Qualifying Criteria | Key Performance Indicators |

|---|---|

| Environmental Performance | Emissions Energy Water Green Buildings |

| Stakeholder Engagement | Green Leasing Employee Policies Disclosure |

| Public Commitments | GHG Reduction Climate Risk Biodiversity |

| Disqualifying Criteria | Key Performance Indicators |

|---|---|

| Climate Risk | Sea Level Rise, Flood, Heat, Water Stress, Storm |

| Poor Disclosures | Lack of Transparency |

| Rising Emissions | Lack of Interest |

| Business Line | Fossil Fuel and Prison Industries |

| Controversy | Corruption, Regulatory, Human Rights, Displacements |

Engagement

Vert strives to be an active shareholder. REITs have abundant opportunities to maximize stakeholder value by being more sustainable and more transparent. We encourage our portfolio companies to take these opportunities through direct dialogue and coordinated campaigns with other asset owners. We reach out to the companies we hold in the fund at least once annually through a formal campaign. Informal and ad-hoc meetings also contribute to the engagement process.

Examples of Key Performance Indicators

Vert’s Investment Research Group has selected the most material Key Performance Indicators for sustainability in real estate. Our case studies and company profiles of companies bring these to life.

Green Buildings

Optimizing office building performance for people and planet.

Urbanism

Combating suburban sprawl by building warehouses near city centers.

Emissions Reduction

How data centers reduce emissions with renewable energy.

The Vert Global Sustainable Real Estate Strategy operated as a mutual fund from October 31, 2017 and prior to the fund reorganization on December 4, 2023. The investment objectives have not changed. The examples shown are for periods prior to the ETF listing date.

What is a portfolio’s carbon footprint?

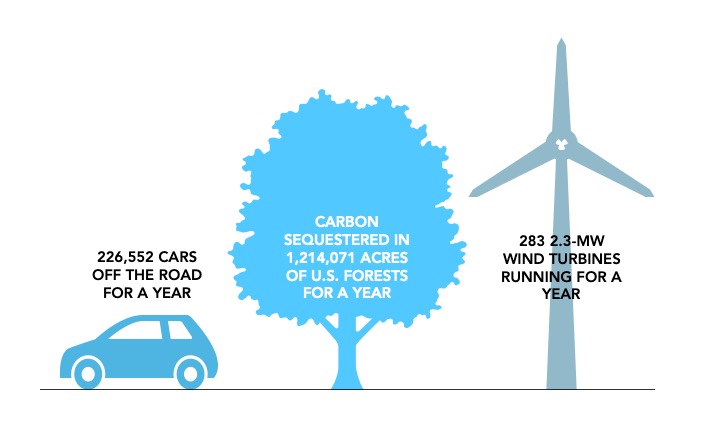

A portfolio’s carbon footprint is the sum of each portfolio company’s emissions. Buildings have large carbon footprints. The Vert Global Real Estate Strategy emphasizes investing in companies that are actively reducing their footprint by lowering emissions.

VGSR: The ETF

VGSRX Converted to an ETF

We are pleased to announce the mutual fund is now an ETF.

The reorganization took place on Monday December 4th, 2023. Investors in the mutual fund had their shares exchanged for shares of equal value in the ETF.

In the recorded webinar (to the left), Vert and Andres Torres from Dimensional explain the mutual fund’s conversion to an ETF:

- Why Vert is converting the Fund to an ETF.

- What will remain the same, and what will change.

- How Dimensional’s patient and flexible trading strategy works in ETFs.