Vert Global Sustainable Real Estate ETF (VGSR)

ETF Commentary

December 31, 2023

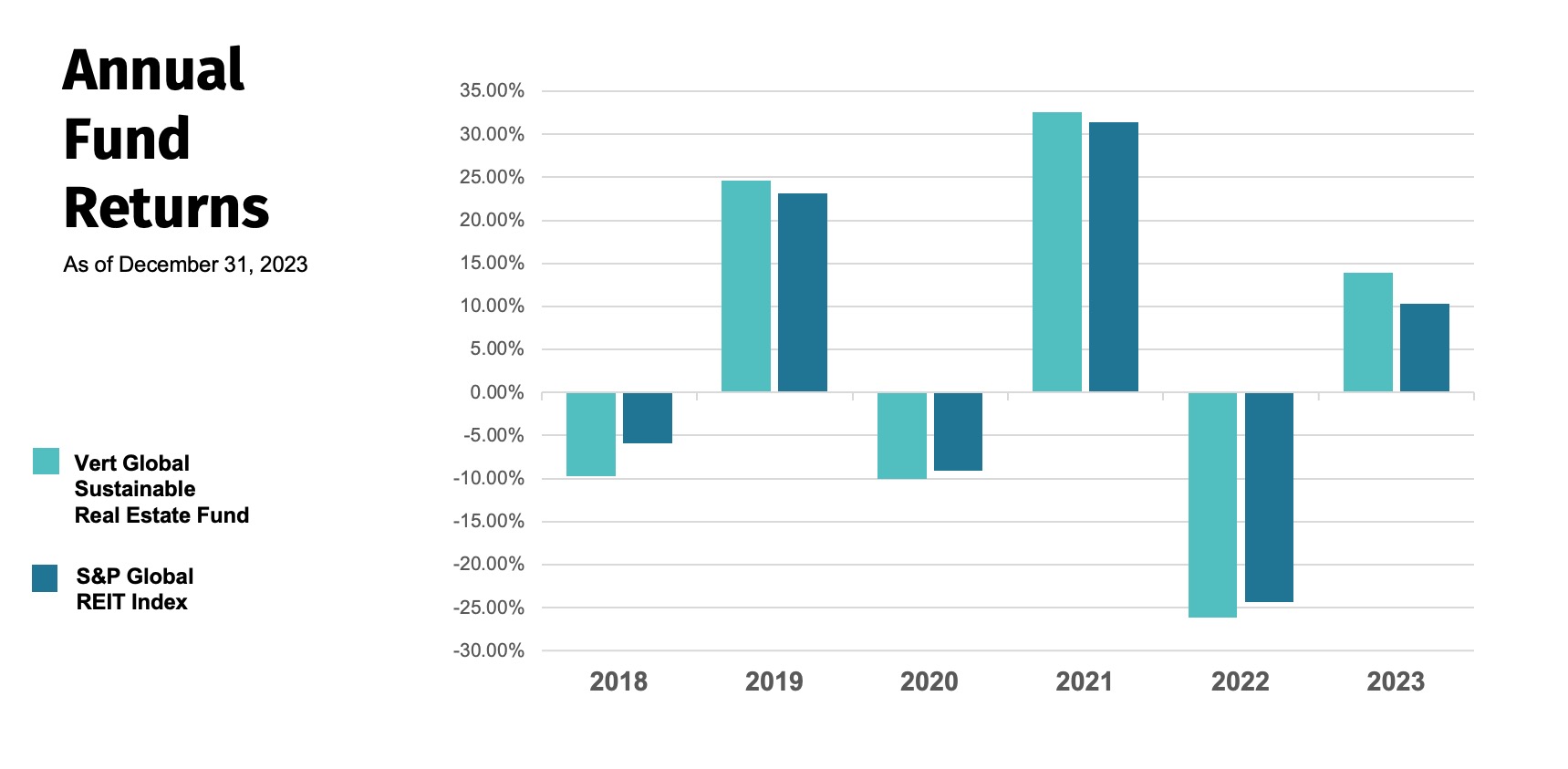

| For the period ending December 31, 2023 | 3 Month | YTD | 1 Year | 3 Year | 5 Year | Since Inception 10/31/2017 | |

|---|---|---|---|---|---|---|---|

| Vert Global Sustainable Real Estate ETF | NAV | 18.14% | 13.91% | 13.91% | 3.69% | 4.55% | 2.57% |

| Market Price | 18.60% | 14.35% | 14.35% | 3.82% | 4.63% | 2.64% | |

| S&P Global REIT Index | 15.47% | 10.26% | 10.26% | 2.21% | 4.16% | 3.01% |

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-740-VERT. Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Return figures over 1 Year are annualized. The fund Gross Expense Ratio is 0.62%. The fund Net Expense Ratio is 0.45% via expense limitation. Contractual fee waivers through December 4th, 2026. The net expense ratio applies to investors.

Fourth Quarter 2023 Update

- The mutual fund successfully converted to an ETF in December. VGSR is now listed on NASDAQ.

- AUM at year end was $348 million.

- In this quarter’s Spotlight we cover “Voluntary Reporting Frameworks Become Mandatory”.

Commentary Slides

DOWNLOAD

Explore more commentaries.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to change.

Please refer to the Prospectus for full risk disclosures. All data as of December 31, 2023 and subject to change daily.