REITs Responding to COVID

Focusing on Tenants, Employees, and Communities

The Vert Global Sustainable Real Estate Fund invests in real estate investment trusts (REITs) that we have determined are committed to sustainability. We engage with the fund holdings throughout the year; we want companies to know that we are investors who are concerned about ESG issues and want to see improvement in performance. Recently, we reached out to a number of firms in the fund to understand how REITs are taking action in the face of a global pandemic. What does “leading” in a pandemic look like? Are there emerging best practices?

We’re all trying to make sense of what is happening in the local, national, and global economy and how to plan for today and prepare for tomorrow during the global health crisis. In normal life, it is difficult to not place your lived experience onto the experience that everyone else is having, and it is just as true during this time, when for all intents and purposes we all seem to be living through the same crisis. Though, this really isn’t the case. We are not experiencing the crisis in the same way. Similarly, the different sectors within real estate are responding to COVID in different ways.

REITs, Real Estate and the Broader Economy

We sometimes refer to the real estate sector as the supplier of the built environment to the overall economy. It is, of course, a distinct type of business, but its fortunes are directly tied to the other business sectors, individuals and households that it serves. This is particularly evident in this crisis. REITs that serve the tech sector like data centers and wireless infrastructure REITS are up over 10% in 2020 according to the FTSE Nareit Real Estate Index series. Warehouse REITs that hold distribution centers for goods delivered to homes and shops have remained flat, as e-commerce has picked up the slack of in person shopping. Much has been written of the death of retail, but even within this narrow sector we find dispersion. Shopping centers anchored with grocery stores have held up better than traditional malls, which remain largely closed. And of course, the Hotel and Resort REITs are still down by up to 50% as travel is still largely suspended.

REITs hold only about 10% of the commercial real estate market in the U.S. and even less in international markets. REITs own and operate most of the different type of real estate, but they tend to be biased toward the more expensive locations, and the higher quality properties. It may be the preference of public equity investors for more Class A properties, or it could be that the capital provided by public markets makes purchasing these more expensive properties more possible.

REITs are generally well capitalized

The discipline of the public markets forces many REITs to be better capitalized than other real estate owners. Public REITs have lowered their debt levels, and lengthened the maturities of that debt, since the 2008 crisis. Many management teams have kept ample liquidity available. This access to capital is providing REITs with the capability to not only withstand the pandemic, but assist their tenants, employees, and communities in making it through the crisis, and we will give examples of that below.

REITs have the resources to repurpose space

There is much speculation about how the need for space might shift post-COVID. “Working From Home” (WFH) works for some, particularly in tech and finance, and a few firms have said they may not need as many employees in the office as before. But others believe that reduction in demand will be offset by the need to de-densify offices to provide workers more space for social distancing. Still others point out the many situations in which WFH is sub-optimal, particularly for families with children. We believe it’s a bit pre-mature to make firm conclusions. It is likely that the better capitalized REITs will be the owners that have the budget to redevelop assets in response to any shifts in how space is used.

We won’t shed a tear for the loss of a few soulless suburban offices, and the non-descript business hotels that serve them. Neither will we lament the demise of tired old shopping malls, of which the US in particular has way too many. Many of these were already being remade into multi-use spaces with residences, offices, and recreational sites. We believe these mixed-use spaces are better for their communities.

A Near Term Outlook

NAREIT’s survey of rent collections showed marked improvements in June 2020. Shopping centers collected more than 60% of typical rents in June, compared to less than 50% in April and May 2020. Free standing retail rents rose from 71% to 79% and health care REITs increased from 90% to 95%. Rent receipts continued to be close to normal, i.e. above 95%, for industrial, apartment, and office REITs. As the economy re-opens, perhaps in fits and starts, we can expect rents to improve but they won’t fully return to normal until the economy does. It makes sense to us that valuations of REITS are down 20% overall, as uncertainty is still the dominant sentiment.

The Response to COVID is Human

Our current global health crisis is unique in many ways, including the fact that today’s business owners have not operated through a pandemic before. We surveyed a couple dozen companies currently included in the fund to learn what they were doing in response to COVID. Similar responses emerged. The disease is affecting people, and in the business context it is affecting human capital. The REITs responses have coalesced around human capital in the supply chain (or value chain) of the business: the tenants, the employees, and the community. In the ESG framework (environmental, social, and governance), REIT responses to COVID are predominantly “S” metrics focused on the health and well-being of tenants, employees, and communities. In this section we collate the examples of REIT activity with these stakeholders.

Tenant Engagement

We measure how REITs engage with their tenants as a measure of sustainability because of the particular nature of the owner/tenant dynamic. In many buildings, the tenants control how they use their space, while the owner only controls common areas like lobbies, elevators, and parking. For the building to consume less energy and water, and produce less waste, the owner must find ways to encourage tenant behavior. Sustainability requires a partnership, and the better REITs see their tenants as an asset in this regard.

The pandemic has greatly increased the need for engagement between owner and tenant. We have seen many examples of REITs helping their tenants to encourage continued occupancy, reduce turnover, and move routine in-person activities online with new technology-enabled processes.

Measures to help mitigate financial impacts arising from the pandemic

In this initial period of uncertainty, there is a focus on lowering occupant turnover or vacancies by offering rent relief or deferrals.

- Equity Residential, a US residential REIT, created payment plans, is waving late fees, and halting evictions for residents who can document they are adversely financially impacted. They are offering resident renewals with no rent increases and providing flexible lease renewal options.

- AvalonBay, a US residential REIT, provided flexible lease renewal options with no rent increases for leases expiring end June. AvalonBay also created payment plans for residents unable to pay their rent if they have been impacted by COVID. They are also waiving late fees.

- Commercial Office Property Trust (COPT), a US office REIT, offered free rent to their tenants who are small business food vendors for the months of economic shutdown due to COVID. It was not deferred rent, but free rent, to support these small, often family-run businesses, so they would be in a position to resume key services for building tenants upon re-opening.

- Sekisui House, a Japanese residential REIT, has a handful of commercial tenants in their residential buildings who requested rent relief. In these cases, management responded by deferring payment and reducing their rents.

- Workspace Group UK, a UK office REIT, offered over 90% of their business center customers a 50% reduction in rent and a rent deferral until end June. After that date, they’re working with customers on a case by case basis. The remaining 10% of tenants are larger businesses with larger financial reserves.

- Hersha Hospitality Trust, a US hotel REIT, immediately sought ways to preserve cash as revenues dried up. They shored up their business operations with voluntary employee pay cuts, paid board member compensation in company stock, and suspended the dividend. This allowed them to continue operating their hotels, paying staff, and maintain their properties.

Increase use of technology

There is a move towards more widespread use of technology to replace in-person interactions.

- Equity Residential introduced “touchless” new leasing and service processes designed to limit physical contact between management and residents.

- AvalonBay moved resident support to phone and email communication. They created virtual tours for and self-guided tours for prospects.

- Vornado, a US office REIT, implemented touchless technology for building entry turnstiles. This was both a security and a health-and-safety protocol to reduce contact between tenants and high-touch surfaces while simultaneously controlling building access.

Employee Engagement

The pandemic is reminding companies of the value of human capital in business operations – the employee as a critical stakeholder. The government mandated shutdowns forced companies to operate remotely whether or not they were fully equipped to do so.

Work from home

The pandemic has been a real challenge for businesses who previously refused to offer remote working or flexible working policies. It is one thing to get the technology setup to work but it’s another to acknowledge the worker is not only an employee but also a person who may have other responsibilities they can’t ignore when working from home, be it children or caring for other family members. The technical support of remote work is required, but so too is the psychological support that team members need, especially now, to work productively and cohesively.

Supporting employees by allowing working from home has become the new minimum requirement across sectors. Many REITs instituted new work from home policies and are not yet mandating employees return to the physical office. Some REITs have gone beyond the minimum and are supporting their employees with additional assistance to work from home, or a hybrid flexibility to work either at home or the office.

- Great Portland Estates (GPE), a UK office REIT, no staff has been let go and everyone has IT equipment to work from home. The HR team created “GPE at home,” which formalized their response to supporting home work. They are asking how can they support working parents, offering paid-time off, expanding video well-being offerings, and focusing training on virtual teamwork and internet best practices. The company finds it important to stay connected hosting virtual social events like pub quizzes and periodic surveys to get worker feedback.

- Sekisui House implemented working from home policy. Furthermore, they made paid holidays available for employees who find it difficult to report to work because of childcare responsibilities or pregnancy.

- Link, a Hong Kong REIT, is encouraging staff to take block leave vacation (5 continuous days), during which they should not be doing anything work related. Additionally, the company has subscribed to a third party “Employee Assistance Hotline Service” that any employee can use should they feel the need to communicate with someone or seek help.

Extending leave and health benefits

Businesses that almost completely shut down, like many hotels and shopping malls, suddenly had no revenue coming in but still had full labor costs. Others had revenue, like residential REITs, but had no work for certain employees, like leasing agents. Rather than terminate employees immediately to reduce costs, some REITs took a longer view. They determined it more prudent to provide benefits to keep staff ready to return to work upon reopening, as this would reduce the need to find and train new associates.

- Equity Residential is providing each employee with extended emergency leave, and resources to support their physical and mental well-being.

- AvalonBay is supporting its associates with new, temporary leave policies and is providing all full- and part-time associates with up to six weeks of emergency paid leave to use in the event they have been materially impacted by COVID. They agreed to pay the full cost of testing and inpatient treatment resulting from COVID for members of its healthcare plan. The REIT expanded their Associate Relief Fund to provide immediate financial support of up to $5,000 to associates experiencing need.

- Pebblebrook, a US hotel REIT, was forced to close most of its hotels during March and April. Rather than have layoffs, the corporate employees all took pay cuts. Hotel employees you might see as a visitor, i.e the staff, are usually employed by the individual hotel operator not Pebblebrook. Most of these employees were furloughed by the operators. Nevertheless, Pebblebrook choose to pay these furloughed hotel employees healthcare benefits during their period of unemployment.

- Host Hotels, a US hotel REIT, also had operators who furloughed 80% of their employees. Host is providing all of the health benefits that employees would have lost. Host is continuing its contract work around sustainability initiatives in order to minimize layoffs.

Community Engagement

In this crisis, community engagement is all about building resiliency. REITs recognize the importance of the economic health of the communities where they operate. The leading REITs are asking how they can leverage their assets or network to help those in need during these extraordinary circumstances.

Use of buildings to help others

- Gecina, a French REIT with a diversified portfolio of office space, retail and residences, is offering their unoccupied student accommodations to healthcare workers and victims of domestic violence.

- Hersha kept 7 out of 9 of their Manhattan hotel properties open to house frontline healthcare workers who didn’t want to return home to potentially expose their families to COVID. These essential workers became 90% of their occupants during this critical time. They also contracted with the local government to provide discounted rates for members of the New York Police Department and the New York Fire Department. Outside the NY metro area, one Hersha hotel housed the homeless.

- Regency Centers, a US retail REIT, started a program where individuals could purchase meals from their restaurant tenants that would then be donated to local frontline workers. They’ve also partnered with cities and local charities to create food distribution sites on their parking lots.

- Unibail-Rodamco-Westfield, a French retail REIT operating globally, has made several locations available to health authorities to stock medical and sanitation materials, set up testing sites and field hospitals.

Philanthropic Donations and Company Foundations

- Equity Residential made donations from the company’s Equity Residential Foundation to groups assisting the homeless and others in need in their local communities.

- Host Hotels created a giving fund for employees and made donations to Feeding America.

- AvalonBay doubled its partner contributions in 2020 to provide additional funding to their philanthropy partners in each region.

- Corporate Office Properties Trust (COPT) runs an employee-directed pool of charitable donations which gave $40,000 to local food banks. COPT also brokered an arrangement for their food vendor tenants to supply the purchased food to food banks, thereby assisting their tenants and the local community simultaneously.

- Great Portland Estates created a Covid-19 Community Fund and has distributed more than £300,000 for immediate relief. They are working with long-term charity partners to identify these priority areas: 1) vulnerable groups, 2) access to green spaces, 3) support mental health and well-being, and 4) aid children who cannot access remote learning.

- Ventas, a US healthcare REIT, is holding virtual employee charity runs to both encourage community building among employees working from home and to raise donations for two organizations: Direct Relief (for direct support of health care workers) and Meals on Wheels.

Healthy Buidings: Buildings affect its human occupants

Before the pandemic, research connected healthy buildings to worker productivity. Twenty years ago, researchers at Harvard School of Public Health published a study “Risk of Sick Leave Associated With Outdoor Air Supply Rate, Humidification, and Occupant Complaints.” It found 57% of all sick leave was tied to poor ventilation.

Not surprisingly, building codes have long require a minimum level of air quality, and green building certifications award more points to buildings with better air filtration systems, higher refresh rates, and access to outdoor air.

Over the last few years, new building certification programs were developed to identify buildings that positively contribute to a person’s health and productivity. The certificates FitWell and WELL were designed with the occupant in mind. They go beyond the standard green building certifications by focusing on how the design, the air quality, and the materials in the building affect well-being. Very few buildings so far have achieved these designations but interest in them is rising, and the pandemic is likely to boost adoption.

Early research on COVID’s spread indicated that virus transmission is through respiratory droplets. This has put the onus on building owners to support building cleanliness and air quality. Owners are turning up air refresh rates, installing better filters, and increasing the frequency and intensity of cleaning regimens.

Property health and safety

REITs are engaging with tenants around sanitation protocols. Communicating local and state guidelines is the bare minimum. Protocols put in place for entryways and common areas are similar across property types and regions. These protocols include body temperature checks at entry, required wearing of face masks, and increased hand sanitizer stations. Most are now legally required to provide these resources in order to re-open. Here are specific illustrations of what some REITs are doing:

- Vornado is requiring touchless entry systems.

- Empire State Realty is using MERV-13 filters for their ventilation systems.

- Boston Properties has nursing staff checking temperatures at entry.

- AvalonBay is limiting maintenance request to essential or emergency services only and all employees were given personal protective equipment (PPE) to use at work.

Other REITs launched new programs to improve health and safety:

- Hersha Hospitality Trust, a US hotel REIT, released a portfolio-wide program called “Rest Assured” in conjunction with their hotel operators. The program is guest-facing. It includes protocols for company associates to help guests navigate their health during their stay. It also features service offerings for guests such as in-room food delivery and other ways to minimize exposure.

- Healthpeak, a US healthcare REIT, has 32% of its portfolio in life science properties which remained open throughout the pandemic. The tenants use lab facilities and therefore cannot “work from home”. Healthpeak developed advanced cleaning protocols and helped tenants organize alternating shifts so lab technicians and scientists could continue operations safely.

- Ventas, Inc’s portfolio is approximately 1/3 senior housing; they have many tenants in the at-risk population. Management and operators initiated discussions early on in order to respond effectively. They restricted external visitors from the outset of the pandemic. Ventas also setup a dedicated resource website for their tenants to understand and manage COVID. Ventas is proactively securing COVID testing for operators’ employees and residents at all of their facilities.

- Regency Centers, a US retail REIT, created “Pick-Up & Go Zones” for their grocery-anchored properties. These dedicated parking stalls allow for fast customer curbside pick-up. They also added social distancing decals to sidewalks, tenant storefronts and common areas.

End to office densification

COVID has accelerated many trends, most notably the increased focus on health and well-being, and with it, supporting more flexible working conditions. To return to the workplace, many businesses are willing to continue support working from home for some and taking the resulting opportunity to give workers in the office more space.

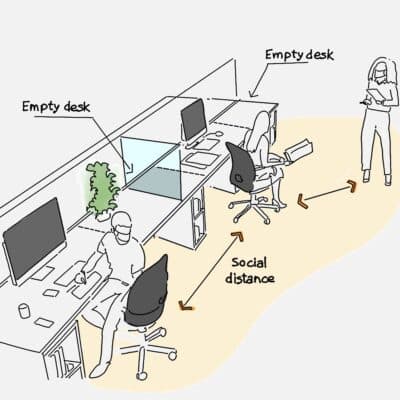

In recent years the trend of office densification – packing as many people into an office by eliminating separate offices in favor of “hot desks” and shared workspaces – has lost favor. Originally touted to foster collaborative working and flatten hierarchal corporate culture, open workspaces are often more distracting and less productive. And in the current pandemic, less healthy.

In response to COVID, office space de-densification will help workers return to the office safely. REITs are helping tenants to altering existing office spaces to accommodate less workers in the same leased office space. Current guidelines rolled out in several countries require people maintain 2 meters or 6 feet of space between each other. Some regions, like NYC, are setting whole building occupancy capacity limits where the building can only accommodate 50% capacity at any given time and is not return to 100% personnel capacity.

The REITs corporate teams are finding ways to return to the office both for themselves and their office tenants. Often this means letting less employees into the building, reducing elevator capacity, removing desks in the office and creating alternating schedules.

- Link, a Hong Kong REIT, operates in a city that never completely shutdown. Even so, the corporate team started A / B schedules for people to alternate coming into the office. They needed to build-up technological resources to support employees choosing to work from home.

- Sekisui House, a Japanese residential REIT, didn’t close their offices completely; they staggered office hours for their employees. They minimize the risk of virus transmission in the workplace through enhanced disinfection procedures, increased employee distance through replacement of seats, and installing partitions.

Sharing Thought Leadership and Best Practices

Many REITs have spent a tremendous amount of resources researching best practices to insure safe working conditions in the pandemic. Some are sharing their findings for the general good, and some are collaborating with each other and industry bodies to accelerate the recovery.

- Boston Properties, a US office REIT, hired Dr. Joseph Allen, Director of the Healthy Buildings Program at the Harvard T.H. Chan School of Public Health to help create an extensive Health Security Plan for its employees, tenants, and visitors to its properties. The comprehensive plan outlines changes to the properties, but also helps tenants feel safe when they arrive at work. Boston Properties uses multi-channel marketing to communicate their plan to stakeholders through the publicly available written report and short instructional videos.

- Great Portland Estates created a playbook called “Occupiers Building Guide: Return to the Workplace” for each building to be “COVID secure” outlining social distancing requirements, providing hand sanitizers, developing an app to allow secure turnstile barriers to open without touching. They made this publication available on their corporate website.

- Link, a Hong Kong REIT, co-chairs the UNEP Finance Initiative Property Working Group. The group released a publication early in Spring 2020 on property owner responses to COVID in order to share ideas and find solutions to problems that perhaps more than one tenant, one company, or one community was facing.

Boston Properties, GPE, and the members of the UNEP Property Working Group made their guides publicly available so that others including competitors can use it for ideas. In this moment of great uncertainty, while business is continuing (whether or not people are in office suites) and the global economy is open, company leadership is voicing a need for collaboration to find solutions. Communicating publicly and sharing it widely demonstrates a desire to be transparent even as the science is evolving and practices adjust accordingly.

Conclusion

Throughout the pandemic, we have been reaching out to REITs in our portfolio to learn how they are adapting to the crisis. We have seen the deployment of a host of creative solutions to many thorny issues across multiple property types. Even though the solutions will continue to evolve as REITs get better at managing COVID, we wanted to share some of the developing best practices now. It has become very apparent that returning to normalcy in work and play will require our buildings to be safe, and REITs have an outsized role in this effort.

At this point, many of the responses by REITs have emphasized the ‘S’ in the ESG framework. Companies are looking to take care of their stakeholders first and foremost, which they see as a necessary first step to re-open. REITs are stepping up across sectors to alleviate adverse effects of the shutdown for tenants, employees, and communities. By focusing on health, companies have the best chance to reduce the economic losses they are already suffering to get back to business as soon as possible.

Top ten holdings as of June 30, 2020: Equinix Inc 5.02%; American Tower Corp 4.74%; Prologis Inc 4.73%; Digital Realty Trust Inc 4.34%; Equity Residential 3.43%; Welltower Inc 3.37%; AvalonBay Communities Inc 3.37%; Simon Property Group Inc 3.29%; Alexandria Real Estate Equities Inc 3.22%; Goodman Group 2.74%.

FTSE Nareit Real Estate Index is a market capitalization-weighted index that and includes all tax-qualified real estate investment trusts (REITs) that are listed on the New York Stock Exchange, the American Stock Exchange or the NASDAQ National Market List. The FTSE Nareit All REITs Index is not free float adjusted, and constituents are not required to meet minimum size and liquidity criteria.

The Vert Global Sustainable Real Estate Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory, and if available summary prospectuses contain this and other important information about the investment company, and may be obtained by calling 1-844-740-VERT or visiting www.vertasset.com. Read carefully before investing.

Mutual fund investments involve risk. Principal loss is possible.

The Vert Global Sustainable Real Estate Fund is distributed by Quasar Distributors, LLC.