SL Green Realty

March 2022

By Vert Asset Management and Soleil Engin, Sustainable Finance Researcher

“Our investment in the future of New York City is underscored by the principles of ESG.” — SL1

Ticker

SLG(NYSE)2

Headquarters

New York, New York

Market Cap

USD $5.2 billion

Company History

1980 SL Green is Founded

1997 IPO on NYSE

Properties

76 properties:

Office

Retail

Development / Redevelopment

Total Sq. Ft.

35.3 million sq. ft.

Green Building Certifications

LEED Certified

22.5 million sq ft.

91% of portfolio

*Data as of December 31, 2021.

Specialized Areas of Achievement

Fitwel Certified 6 properties

WELL Health-Safety Rating for the Entire Portfolio

WiredScore Certification 26 Properties

Recent Awards

GRESB

Green Star 2019-2021

“A” Rating on Public Disclosure 2017-2021

ENERGY STAR Partner of the Year 2015-2016, 2018-2021

Green Lease Leader Gold 2020

Dow Jones Sustainability World Index 4th consecutive year

Index Constituent 2020-2021

SL Green’s Role in Urban Life

New York City is home to 8.80 million people and over 1 million buildings. Manhattan is an island city surrounded by three rivers and the Atlantic Ocean which prevents outward expansion. Manhattan has an exceptionally high population density exacerbating the effects of increased pollution.3 It is estimated that 2,700 New York residents die every year from conditions attributed to airborne particulate matter from air pollution. Curbing climate change and enhancing human wellbeing go hand in hand since short lived climate pollutants such as methane, black carbon, and hydrofluorocarbons have detrimental effects for both public health and environmental health.4

SL Green Realty Corp is one of New York City’s largest office landlords with a focus on acquiring and maximizing the value of Manhattan-based office buildings. With a 23 million square foot core portfolio, the company recognizes the role their properties can play in creating a future that is healthier for both people and planet. SL Green is dedicated to minimizing the environmental footprint of their properties to reduce pollution in the city of New York. The company aims to mitigate damage to properties and property value from extreme weather patterns caused by climate change, as demonstrated by recent Hurricanes Ida and Sandy. SL Green’s focus on properties’ green building certification and energy performance helps the company avoid potentially costly fines and aligns with New York City’s goal of reaching a carbon neutral economy by 2040.

Physical Transition Risks

SL Green is committed to sustainability within their corporate strategy since climate risks such as hurricanes, storms, and flooding can negatively impact property values. 2020 marked the tenth consecutive year that the US has had more than 8 multi-billion dollar disasters. In 2021 Hurricane Ida cost $95 billion in total damages.5 Hurricanes Sandy and Ida have demonstrated that the East Coast is already at risk for extreme weather patterns due to climate change.

Climate change could also increase the cost of property insurance. In 2024 New York will release updated flood maps displaying current and predicted flood zones. These updated flood maps are expected to place thousands more buildings and residents in flood zones, thus requiring property owners to pay more for flood insurance.6 As one of the largest office landlords in Manhattan, SL Green’s building mitigations, such as investment in flood resistant infrastructure, can have a deep impact on the sustainability of the city.

SL Green performs risk assessments for all of their properties at least once every 6 months. Preventative maintenance helps the buildings be as energy efficient as possible, preemptively reducing costs and emissions. Structured around three key areas—Efficiency, Tenant Experience, and Industry Leadership—SL Green focuses on leveraging low-cost solutions to enhance building performance in coordination with tenants. By working with suppliers, tenants, and contractors to ensure that materials are LEED compliant, responsibly sourced, nontoxic, and recycled, SL Green prioritizes both environmental and human wellbeing.

Regulatory Transition Risks

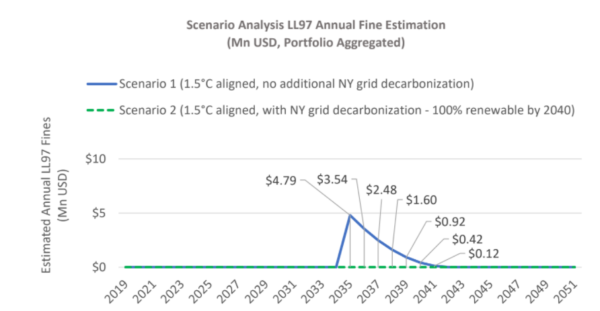

Given New York City’s target of reaching net-zero electricity emissions and 100% renewable energy by 2040, SL Green’s emphasis on sustainability for their properties also avoids future conflicts with policies that would then require extensive and costly renovation measures. NYC environmental regulatory measures include Local Law 97, which mandates that most buildings over 25,000 square feet will be fined if they do not meet regulatory standards on energy efficiency and greenhouse gas emissions by 2024, with stricter limits coming in 2030.7 Due to proactive consideration of environmental factors, SL Green does not anticipate any fines through Local Law 97 across all compliance periods.

By investing to enhance energy efficiency and procure renewable energy, SL Green is preparing for long-term efficiency and avoiding costs and potential conflicts with policy issues.

Top-Down Support for ESG Goals

ESG (Environment, Social and Governance) initiatives receive top-down support and are prioritized company wide. According to their 2021 Task Force on Climate-related Financial Disclosures (TCFD) Report, the Board works with management to develop business strategy with ESG goals. The Board directly oversees the ESG program to assess transition risks, physical risks, and associated opportunities. SL Green’s Sustainability Team is led by the Chief Operating Officer, who oversees 800 employees and is responsible for managing building operations, construction, IT, and sustainability. By placing the COO in charge of ESG operations, sustainability is centralized across all business operations.

The TCFD Report outlines how the company prioritizes social welfare with a rigorous supply chain policy ensuring fair wages, ethical working conditions, and an absence of human rights violations. Suppliers are required to meet and exceed regulatory compliance and are further scored on ESG performance across 4 categories: Environment, Labor & Human Rights, Ethics, and Sustainable Procurement.

Green Lease Leader

SL Green recognizes the central role their tenants play in supporting their mission driven approach to environmental welfare. Tenants account for over 60% of building energy use and emissions. SL Green is committed to refining lease language to enhance collaboration with tenants on environmental goals to create green leases. The company also uses iES EnergyDesk, a real-time and data driven energy management system, where sub-metered tenants have access to data on their energy consumption in sub-hourly intervals. This high-level data transparency provides tenants with the information necessary to visualize their carbon footprint so they can make informed decisions to accelerate reductions.

Health and Wellbeing

Part of SL Green’s response to the COVID-19 pandemic was obtaining the WELL Health-Safety Award for the entire portfolio. The WELL Health-Safety Award is an evidence-based rating verified through the International WELL Building Institute that focuses on operational policies, maintenance protocols, stakeholder engagement, and emergency plans to address a post-COVID-19 environment.

The company developed an in-house SL Green Forward Program to promote safety, cleanliness, and wellbeing for tenants. The SL Green Forward Program includes 5 categories: Cleaning and Sanitization Procedures, Emergency Preparedness Programs, Health Service Resources, Air and Water Quality Management, and Stakeholder Engagement and Communication. SL Green kept tenants healthy during the COVID-19 pandemic by increasing cleaning frequency, installing the highest efficiency filters and passive thermal scanners, applying social distancing markers, establishing a re-entry plan to address physical distancing, and modifying system controls to boost the supply of outdoor air.

Project Spotlight: One Vanderbilt Avenue

One Vanderbilt is located in the heart of mid-town Manhattan. It has a direct entrance to Grand Central Station helping tenants travel easily by public transport.

The building is projected to receive the highest LEED certification ever granted. Construction materials such as steel and concrete are sourced from recycled materials as much as possible, reducing its embodied carbon footprint. Embodied carbon can account for over 50% of a building’s total carbon footprint.

The property also features a 150,000 gallon water tank to capture rainfall for use in mechanical systems and to cool the building. This will conserve over 1 million gallons of water annually. This property features ultra-high efficiency restroom fixtures which reduce water consumption by 40%.

SL Green is pursuing the highest level of WELL Compliance certification for employee well-being. The building includes floor to ceiling windows, biophilic design elements, features to minimize tenant exposure to outside pollutants, and low VOC materials to reduce long- and short-term health risks.

1 SL Green Realty. (2021) “SLG ESG” Available at: https://sustainability.slgreen.com/wp-content/uploads/2021/12/SLG-2021-ESG-Report.pdf

2 SL Green Realty, Inc is 0.49% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of December 31, 2021.

3 Jeremy Hinsdale |June 6 et al., “By the Numbers: Air Quality and Pollution in New York City,” State of the Planet (Columbia Climate School, January 15, 2020), https://news.climate.columbia.edu/2016/06/06/air-quality-pollution-new-york-city/.

4 Katherine Ross and Jessica Seddon, “Curbing Climate Change and Preventing Deaths from Air Pollution Go Hand-in-Hand,” World Resources Institute, October 29, 2018, https://www.wri.org/insights/curbing-climate-change-and-preventing-deaths-air-pollution-go-hand-hand.

5 Pippa Stevens, “Hurricane Ida’s Damage Tally Could Top $95 Billion, Making It 7th Costliest Hurricane since 2000,” CNBC (CNBC, September 8, 2021), https://www.cnbc.com/2021/09/08/hurricane-idas-damage-tally-could-top-95-billion-making-it-7th-costliest-hurricane-since-2000-.html.

6 “New Flood Maps Are Coming. They Won’t Look Pretty.,” Spectrum News NY1 (Spectrum News NY1, 2021), https://www.ny1.com/nyc/all-boroughs/news/2021/08/02/new-flood-maps-are-coming–they-won-t-look-pretty-.

7 “Local Law 97,” Local Law 97 – Sustainable Buildings, accessed February 13, 2022, https://www1.nyc.gov/site/sustainablebuildings/ll97/local-law-97.page.

Please refer to the Prospectus for full risk disclosures. All data as of December 31, 2021 and subject to change daily.