American Tower Corporation

March 2023

By Vert Asset Management and

Nicolas Lopez-de-Silanes, Sustainable Finance Researcher

“Our sustainability program is built upon three pillars—environment, social and governance —and our commitment has a positive impact on business performance.” – American Tower Storage1

Ticker

AMT (NYSE)2

Headquarters

Boston, MA

Market Cap

USD $98.6 billion

Company History

1995 begins as a subsidiary of American Radio

2012 becomes a REIT

Properties

approx. 223,000 communication sites

approx. 180,000 properties

25 countries

Green

Features

58 megawatts of solar capacity installed on 11,000 sites

Lithium-ion batteries for energy storage at 13,600 sites

Streaming content on your phone? American Tower makes that possible.

As digital access expands, network operators need to continuously provide connectivity through wireless infrastructure. You might recognize some of these cell towers disguised as fake palm trees along a California freeway or even a shopping mall clock tower. Wireless infrastructure offers crucial support to the digital economy, enabling e-commerce, digital media and virtual education to name just a few applications.3

American Tower (AMT) was founded in 1995 and is one of the largest global REIT by market capitalization. AMT develops, owns, and operates 42,965 towers in the US and 223,000 communication sites globally.

AMT generates revenue by leasing space on cell towers and other types of wireless infrastructure to wireless carriers. To increase network coverage in dense urban areas, AMT arranges leasing agreements with rooftop owners.4 The company offers colocation so that multiple carriers can use a single site. AMT also builds broadcast towers for national broadcast corporations and local station owners.5

AMT provides on-site backup generators to its customers during power outages. Utility service disruptions are occurring more frequently due to extreme weather and our aging “grid” infrastructure.6

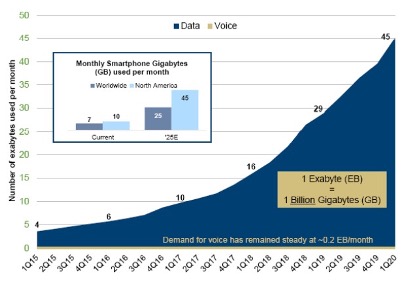

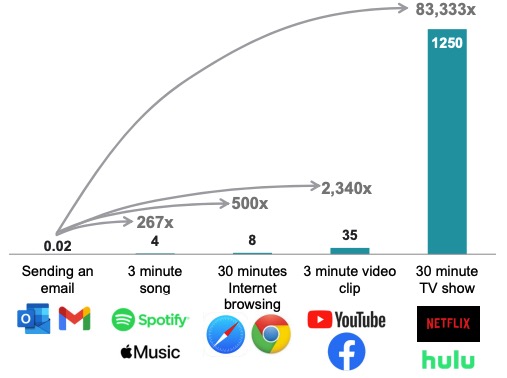

The world’s transition to the “internet of things” has increased demand for streaming data which now dwarfs demand for telephone or voice data (See Figure 1). Streaming a 30-minute TV show takes 1250 megabytes of data or 83,333 times the 0.02 megabytes of data used to pen an email (See Figure 2). With the increase in interconnected data services, the company’s mission is to make wireless communications possible everywhere.

Why are wireless towers included in the real estate asset class?

One defining real estate characteristic of cell towers is that they are installed in a fixed location such as on land or on a rooftop. The construction and development process for wireless infrastructure is carried out in the same way as for other types of real estate which involve siting, land acquisition, architectural design, zoning, land-use regulation review and construction.7

Second, wireless infrastructure derives income from rents with multiple tenants (or colocation) using the same site(s).

The business model of tower REITs diverges from that of traditional real estate. Growth in wireless infrastructure capacity is attributed to increasing demand for data use. Tower REITs often trade like tech stocks more than real estate stocks.8 Modern society’s increased reliance on devices and interconnectivity requires wireless carriers to continue to expand and improve their networks.

How can a tower REIT help green the digital economy?

A company that recognizes the role of business to enable a transition to a low-carbon economy takes action throughout their organization board level governance to daily business activities.

AMT’s board of directors’ corporate governance committee has direct oversight of ESG programs and policies. The Global Sustainability Committee sets targets for the company and the Chief Sustainability Officer (CSO). The CSO reports directly to the Board.9

As part of a Paris-aligned strategy, in 2021 AMT set science-based targets initiative (SBTi) to reduce Scope 1, 2, and 3 emissions. Scope 1 emissions come from combustion vehicle or equipment owned by the company. Scope 2 emissions are from any purchased energy. Scope 3 emissions attempts to capture indirect emissions from business activities such as business travel, capital goods purchase or tenant energy use. SBTi’s are globally aligned, climate science backed emission reduction goals that seek to reduce carbon emissions to effectively limit the earth’s temperature in compliance with the Paris Agreement. The company committed to reduce absolute scope 1, 2 and 3 greenhouse gas (GHG) emissions 40% by 2035 from a 2019 base year.10

Project Spotlight: Diesel Reduction at Sites

A significant portion of AMT’s GHG emissions are due to diesel consumption for on-site generators to provide power to tenants. This is particularly the case in markets where communication services for tenants are provided through unreliable electric grids or are situated in rural areas. AMT’s Asian and African markets account for approximately 99% of the total diesel assets purchased by AMT.11

AMT decreased diesel use and increased on-site energy efficiency with renewable energy and installing energy storage systems. More than $400 million has been invested in this strategy since 2012, allowing the company to extend its portfolio to include over 58 megawatts of solar capacity in approximately 11,000 sites. AMT also equipped 13,600 sites with lithium-ion batteries for energy storage.12 Battery storage helps to improve reliability and flexibility of power at the sites.13

AMT also upgraded 40% of their sites to LED lighting systems. These lighting systems use 65% less energy and have a lifespan 10 times as long as traditional lighting.14

2American Tower is 4.74% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of December 31, 2022.

3T. Riddiough (2021). “Wireless Real Estate: Business Model, Real Estate Attributes, and Competitive Market Structure.”

4American Tower Corporation (n.d.). “Rooftops: Cell Sites for Network Capacity/Coverage Gaps.” AMT. https://www.americantower.com/us/solutions/rooftops.html

5American Tower Corporation (n.d.). “Broadcast Transmission Tower Sites with Master Antenna Leasing.” AMT https://www.americantower.com/us/industries/broadcasters.html

6American Tower Corporation (n.d.)“Backup Power: Shared Generator for Network Outages.” AMT. https://www.americantower.com/us/solutions/backup-power.html.

7T. Riddiough (2021). “Wireless Real Estate: Business Model, Real Estate Attributes, and Competitive Market Structure.”

8ibid.

9 American Tower Corporation (2022). “Sustainability.” AMT. https://www.americantower.com/sustainability/index.html

10Science-Based Targets Initiative (2023). “Companies Taking Action.” SBTi. https://sciencebasedtargets.org/companies-taking-action#dashboard

11American Tower Corporation (2022). “Sustainability Report 2021, American Tower”. https://www.americantower.com/sustainability/index.html

12ibid.

13American Clean Power Association (n.d.) “Benefits of Energy Storage.” Energy Storage Association. https://energystorage.org/why-energy-storage/benefits/

14American Tower Corporation (2022). “Sustainability Report 2021, American Tower”. https://www.americantower.com/sustainability/index.html

Please refer to the Prospectus for full risk disclosures. All data as of December 31, 2022 and subject to change daily.