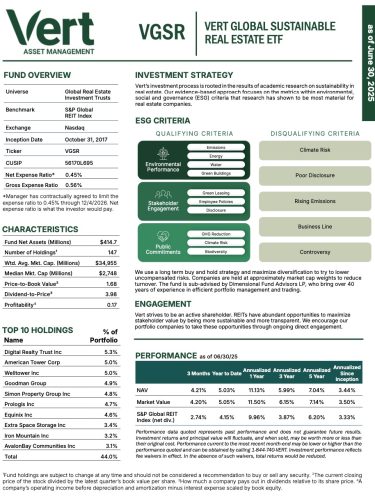

Vert Global Sustainable Real Estate ETF

Money Talks. Speak Up.®

The Vert Global Sustainable Real Estate Strategy operated as a mutual fund from October 31, 2017 and prior to the fund reorganization on December 4, 2023. The investment objectives have not changed. The fund commentaries, fund factsheet, and ESG tear sheet are shown for periods prior to the ETF listing date.

Fund Literature

The Vert Global Sustainable Real Estate Strategy operated as a mutual fund from October 31, 2017 and prior to the fund reorganization on December 4, 2023. The investment objectives have not changed. The annual report, semi-annual report, and schedules of investments of the predecessor mutual fund are shown for periods prior to the ETF listing date.

Characteristics

VGSR Quarterly Characteristics (as of June 30, 2025)

| Characteristics | |

|---|---|

| Wtd. Average Market Cap. ($Millions) | 34,955 |

| Aggregate Price-to-Book | 1.68 |

| Number of Holdings | 147 |

| Sector Weights | |

|---|---|

| Specialized REITs | 22.14% |

| Industrial REITs | 17.54% |

| Retail REITs | 17.43% |

| Residential REITs | 13.17% |

| Health Care REITs | 11.47% |

| Diversified REITs | 8.54% |

| Office REITs | 7.70% |

| Hotel & Resort REITs | 2.03% |

| Top Holdings | |

|---|---|

| Digital Realty Trust Inc | 5.35% |

| American Tower Corp | 5.01% |

| Welltower Inc | 4.98% |

| Goodman Group | 4.86% |

| Simon Property Group Inc | 4.81% |

| Prologis Inc | 4.71% |

| Equinix Inc | 4.57% |

| Extra Space Storage Inc | 3.35% |

| Iron Mountain Inc | 3.23% |

| AvalonBay Communities Inc | 3.11% |

| Top Countries | |

|---|---|

| United States | 66.73% |

| Australia | 9.96% |

| Japan | 6.85% |

| United Kingdom | 5.32% |

| France | 3.45% |

| Singapore | 2.78% |

| Belgium | 1.68% |

| Canada | 0.90% |

| Spain | 0.78% |

| South Africa | 0.45% |

Distributions

| Record date | Ex-Date | Payable Date | Type | Rate Per Share |

|---|---|---|---|---|

| 6/26/25 | 6/26/25 | 6/27/25 | Quarterly Dividend | $0.10506162 |

| 3/27/25 | 3/27/25 | 3/28/25 | Quarterly Dividend | $0.06214456 |

| 12/30/24 | 12/30/24 | 12/31/24 | Quarterly Dividend | $0.0619889 |

| 9/27/24 | 9/27/24 | 9/30/24 | Quarterly Dividend | $0.08991217 |

| 6/27/24 | 6/27/24 | 6/28/24 | Quarterly Dividend | $0.08816990 |

| 3/28/24 | 3/27/24 | 3/29/24 | Quarterly Dividend | $0.14383006 |

| 12/28/23 | 12/27/23 | 12/29/23 | Annual Dividend | $0.26289823 |

| 12/13/22 | 12/14/22 | 12/14/22 | Short-Term Capital Gain | $0.00925 |

| 12/13/22 | 12/14/22 | 12/14/22 | Long-Term Capital Gain | $0.090403 |

| 12/13/22 | 12/14/22 | 12/14/22 | Annual Dividend | $0.04405671 |

| 12/13/21 | 12/14/21 | 12/14/21 | Short-Term Capital Gain | $0.01112 |

| 12/13/21 | 12/14/21 | 12/14/21 | Long-Term Capital Gain | $0.16394 |

| 12/13/21 | 12/14/21 | 12/14/21 | Annual Dividend | $0.25914155 |

| 12/14/20 | 12/15/20 | 12/15/20 | Annual Dividend | $0.15216243 |

| 12/27/19 | 12/30/19 | 12/30/19 | Additional Dividend | $0.01505895 |

| 12/11/19 | 12/12/19 | 12/12/19 | Quarterly Dividend | $0.19458439 |

| *For 2019 there were no capital gains distributed | ||||

| 6/26/19 | 6/27/19 | 6/27/19 | Quarterly Dividend | $0.03056068 |

| 3/27/19 | 3/28/19 | 3/28/19 | Quarterly Dividend | $0.08975919 |

| 12/12/18 | 12/13/18 | 12/13/18 | Annual Dividend | $0.20682226 |

| 12/12/18 | 12/13/18 | 12/13/18 | Short-Term Capital Gain | $0.0042 |

| 12/12/18 | 12/13/18 | 12/13/18 | Long-Term Capital Gain | $0.0092 |

| 12/18/17 | 12/19/17 | 12/19/17 | Annual Dividend | $0.04918164 |

All fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

To receive a distribution, you must have been a registered shareholder of the fund on the record date. Distributions were paid to shareholders on the payment date. Past distributions are not indicative of future trends. Please consult your tax professional or financial adviser for more information regarding your tax situation.

Prior to listing date, the ETF operated as a mutual fund. Distribution information shown prior to the ETF listing date is of the predecessor mutual fund.

To receive a distribution, you must have been a registered shareholder of the fund on the record date. Distributions were paid to shareholders on the payment date. Past distributions are not indicative of future trends. Please consult your tax professional or financial adviser for more information regarding your tax situation.

Prior to listing date, the ETF operated as a mutual fund. Distribution information shown prior to the ETF listing date is of the predecessor mutual fund.