Hannon Armstrong

May 2022

By Vert Asset Management and Jack O’Brien, Sustainable Finance Researcher

“Our vision is that every investment should improve our climate future” — Hannon Armstrong1

Ticker

HASI(NYSE)2

Headquarters

Annapolis, Maryland

Market Cap

USD $3.3 billion

Company History

1981 founded

2013 became a REIT

Climate Focused Investments

Energy efficiency technologies

Green energy projects

Energy and water distribution infrastructure

*Data as of December 31, 2021.

Recent Awards

Supporters of Task Force on Climate-related Financial Disclosures

Joined Net Zero Asset Managers Initiative

Committed to Science-Based Targets Initiative

Transition to a Low-Carbon Economy

In the US, 60% of electricity comes from fossil fuels including oil, coal, and natural gas. Renewable energy costs continue to fall while fossil fuel extraction becomes more costly. In the past, decisions to invest in renewable energy over fossil fuel were made partly for climate reasons. Now pure economics are attracting more investors to renewable energy.

Reshaping Energy Infrastructure One Project at a Time

Typical REIT owning and leasing out buildings. Hannon Armstrong is different. Hannon Armstrong has been providing securitized funding for energy infrastructure projects since 1981. The company provides financing in the form of tax equity, senior debt, subordinated debt, structured equity and common equity. The company recently became a REIT in 2013 after over 30 years of operation.

Hannon Armstrong invests in renewable energy, energy efficiency, and sustainable infrastructure. There are three specific workstreams Behind-the-Meter, Grid-Connected, and Sustainable Infrastructure. Together, these programs aim to introduce more effective and efficient infrastructure to avoid wasted resources and to drive a more adoption of renewable energy resources in the United States.

Hannon Armstrong manages about $6.2 billion in assets across more than 200 investments in projects across these three strategies. About 80% of the REIT’s projects are focused on solar energy, wind, energy efficiency, and the remainder in sustainable infrastructure.

Hannon Armstrong receives income from contracted revenue streams on long-dated assets for 30 years or more. The company’s revenue comes from investment income, rental income, and gain on the sale of receivables and investments. The company is one of the largest landowners of solar fields and receives stable rents on these properties.

Hannon Armstrong invests in assets that are fundamental to the operation of electric power systems. They invest with clients such as Sun Power, Sunrun, ENGIE, Schneider Electric, and Siemens.

Avoided Emissions

Hannon Armstrong does not own buildings. Rather, Hannon Armstrong is in the business of helping building owners and other energy users to decarbonize.

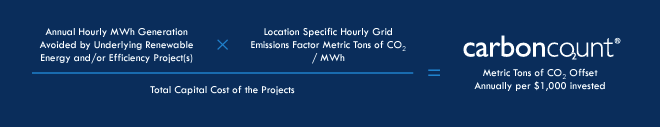

Hannon Armstrong calculates the estimated metric tons of carbon emissions or equivalent avoided, a calculation it calls CarbonCount. The methodology is used to evaluate investments into climate resilient projects. This a type of internal carbon pricing where the organization is placing a monetary value on each ton of carbon emissions. The company also uses this methodology to communicate to the marketplace the carbon performance of their investments. CarbonCount is calculated using the annual hourly mega-watt per hour (MWh) avoided in the project multiplied by a location specific hourly grid emissions factor (similar figure is available from the US Environmental Protection Agency). This figure is then divided by the total capital cost of the project to provide a metric ton of CO2 avoided annually per $1,000 invested. See CarbonCount infographic.

Hannon Armstrong calculates that their investments in renewable energy reduces over 6 million cumulative metric tons of carbon emissions or the equivalent of eliminating emissions from over 700,000 average U.S. homes every year.

Additionally, investment in alternative energy sources also creates jobs in the energy sector. The company’s investments have played a crucial role in the creation of over 400,000 jobs across 48 states in the United States.

What are avoided emissions?

Avoided emissions is an estimated figure of carbon emissions. Companies calculate and use this figure to describe how their products help avoid additional greenhouse gas emissions compared to similar products. This is mostly used in instances where the company’s product reduces emissions relative to the base case.Source: World Resources Institute. (2019). Estimating and Reporting the Comparative Emissions Impacts of Products. GHG Protocol.

Project Spotlight: Grid-Connected Investments

There are number projects included in Hannon Armstrong’s portfolio that enable the grid to be connected to cleaner sources of energy. Here are a couple examples of the type of project that Hannon Armstrong finances:

Utility Scale Solar

Clearway Energy

Provides $663m in preferred equity investment across 7 projects that provide 2 GW of energy in grid-connected wind, solar, and storage. Currently 90% of the generation is contracted to municipalities and commercial & industrial (C&I) off-takers.

Clearway Energy develops and operates clean energy in the US.

Solar-Plus-Storage

ENGIE

Jointly invests in ENGIE’s distributed clean energy generation portfolio of solar and solar-plus-storage in the US. The 70 MW portfolio includes community solar and commercial & industrial (C&I) for ground-mounted, carport and rooftop solar projects.

ENGIE provides utility-scale power to commercial clients. 100% of the company’s portfolio is low carbon or renewable.

1 Hannon Armstrong. (2022). 2021 Impact Report. Available from https://vertfunds.com/wp-content/uploads/2022/11/2021-Impact-Report_fnl.pdf

2 Hannon Armstrong, Inc is 0.36% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of June 30, 2022.

Please refer to the Prospectus for full risk disclosures. All data as of June 30, 2022 and subject to change daily.