Hammerson plc

“The lack of political clarity regarding climate change policy makes it even more important for business to step up and help shape our sector’s response to this increasingly pressing issue.” — Hammerson plc1

Company

Hammerson plc2

www.hammerson.com

Headquarters

London, UK

Market Cap

USD $3.48 billion

Company History

1942 Started in residential property

1948 Expanded into commercial property

1954 Became a public company

Properties

21 shopping centers in the UK, Ireland and France

13 retail parks in the UK

20 premium outlets across Europe

Value-Added

Maintains a sustainable design standard

for commercial developments.3

*Data as of March 31, 2019.

Source: Unsplash

Who is Hammerson plc?

Have you shopped at your local main street or a shopping mall recently? You probably didn’t need to buy nearly as much as you might have twenty years ago. Online shopping has upended the in-person retail experience. Familiar department brands such as, Toy R Us and Sears in the US or Debenhams and House of Fraser in the UK have shut stores and even gone bankrupt. Hammerson plc is a European Retail REIT owning and operating shopping centers predominantly in the UK, Ireland and France. Retail properties like shopping centers, retail parks, and outlet malls have been forced to change as more people turn to online shopping; in the UK online shopping now accounts for 18% of consumer transactions.4 As technology changes how we consume, retail REITs like Hammerson are re-evaluating their portfolio of properties and making changes to how consumers interact with the built environment. Hammerson has decided to dispose of some properties and focus on its large shopping centers, reimagining the role of its retail properties to be places for not just for shopping, but congregating places where people go to experience a “big day out.”5 The company’s program “City Quarters” focuses on diversifying previously retail-only centers to include office, hotel and housing units alongside permanent retail units, pop-shops, events and entertainment. The company actively engages retail tenants to design their space for energy reduction as tenants’ energy use makes up 60% of a property’s overall use of energy.

Strategy Spotlight: Positive Places

The built environment that which we interface with each day has enormous potential to ‘go green.’ Hammerson has put energy reduction at the core of their corporate strategy. In 2017, Hammerson launched its most ambitious targets to-date and a global first for the property sector: to be Net Positive for carbon, resource use, water, waste and socio-economic impacts by 2030. Using these objectives as a foundation, the Hammerson rolled out a company-wide program called Positive Places to rally all departments to create goals and objectives around specified sustainability targets.

Positive Places is the umbrella branding for Hammerson’s 2030 Net Positive targets to: reduce energy consumption, waste generation, and water consumption. The company aims to give more back into the environment and community than is used and connects resource use and business in the following ways:

- Reduce exposure to energy price volatility and carbon pricing.

- Supporting relationships with local stakeholders in developing programs for the local communities.

- Ensure the properties can provide a comfortable environment in a changing climate.

- Identify potential renewable energy projects to include in building design.

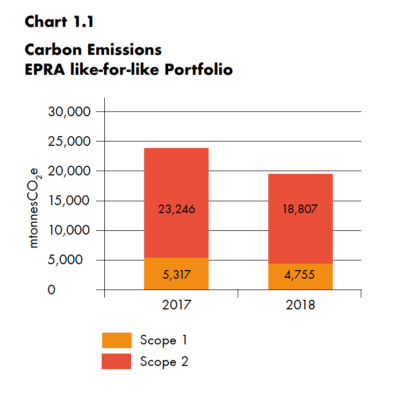

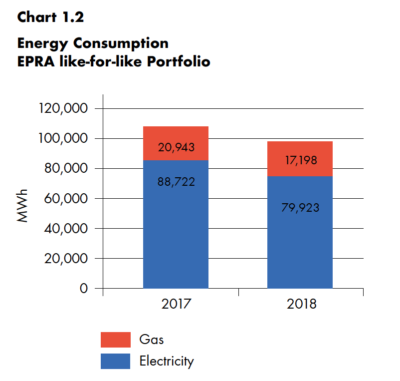

After building a company-wide strategy around these objectives, Hammerson reports an 11% reduction in absolute carbon emissions in 2018 across the retail portfolios, a total reduction of 22% since 2015.6

Hammerson trades on the London Stock Exchange and is subject to the UK Companies Act of 2006. Beginning in 2013, the Act required publicly-listed UK companies to disclose annual greenhouse gas emissions.7 Hammerson reports year-on-year metrics for carbon emissions, energy demand, water demand and waste management. An example of the company’s most recent carbon emissions and energy consumption is shown in Chart 1.1 and Chart 1.2 below:

Note: EPRA refers to the European Public Real Estate Association. The policy group has worked to promote environmental metrics in regulatory and business frameworks.

Source: Hammerson plc (2019). “2018 Sustainability Report: Positive Places,” 14. Hammerson plc.Retrieved from: http://sustainability.hammerson.com/downloads/download417.pdf

Many companies do the absolute minimum for this legal requirement. Hammerson turned this legal obligation into a business advantage to develop their Net Positive goals and the corresponding Positive Places business strategy. Today’s global policy and business landscape is catching up with more formalized climate change reporting guidelines requested through the global Task Force for Climate-Related Financial Disclosures (TCFD) and US-based Sustainable Accounting Standards Board (SASB). Together, TCFD and SASB create an integrated framework and standards to roll-up existing company reporting on climate-related metrics into mainstream corporate reporting.

1 Hammerson plc (2019). “2018 Sustainability Report: Positive Places,” 7. Hammerson plc. Retrieved from: http://sustainability.hammerson.com/downloads/download417.pdf

2 Hammerson plc is 0.46% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2019.

3 Hammerson plc (2019). “Development Approach. Sustainable Design Brief.” Hammerson plc. Retrieved from: http://sustainability.hammerson.com/downloads/download402.pdf.

4 Hammerson plc (2019). “Hammerson plc – Results for the year ended 31 December 2018.”Hammerson plc.Retrieved from: https://www.hammerson.com/media/press-releases/2018-full-year-results/

5 Kollewe, Julia (25 February 2019). “Bullring owner targets £900m-plus sell-off as retail crisis bites,”The Guardian, Business. Available: https://www.theguardian.com/business/2019/feb/25/bullring-owner-sell-retail-crisis-hammerson

6 Hammerson (2019). “2018 Sustainability Report: Positive Places,” 4. Hammerson plc. Retrieved from: http://sustainability.hammerson.com/downloads/download417.pdf

7 Carbon Trust (2019). “Mandatory Carbon Reporting.” Available: https://www.carbontrust.com/resources/guides/carbon-footprinting-and-reporting/mandatory-carbon-reporting/

Please refer to the Prospectus for full risk disclosures. All data as of March 31, 2019 and subject to change daily.