Equity Residential

October 2022

By Vert Asset Management and Eren Isiktas, Sustainable Finance Researcher

“Our purpose at Equity Residential is to create communities where people thrive and our commitment to environmental, social and governance (ESG) issues is at the core of that purpose.” — Equity Residential1

Ticker

EQR(NYSE)2

Headquarters

Chicago, IL

Market Cap

USD $25.2 billion

Company History

1993 founded as a REIT

2001 joined the S&P 500

Properties

310 properties

80,227 apartment units

Green Building Certifications

24 LEED Certified

*Data as of September 30, 2022.

Recent Awards

Residential Overall Regional Sector Leader, 2021

Diversity, Equity, Inclusion Gold, 2021

Committed to Science-Based Targets Initiative

Equity Residential Provides Badly Needed Housing to Urban Markets

The long-standing housing shortage in the US causes problems for American families as well as the national economy and the politics of housing construction.1 Previously perceived as a coastal issue, this is spreading across the country during the post-pandemic period. Almost half of Americans state that the availability of affordable housing in their local community is a significant problem; in early 2018 this percentage was closer to 39%.2 Equity Residential has strived to alleviate the coastal housing shortage with its established presence in Boston, New York, Washington, D.C., Seattle, San Francisco, Southern California. The company is now targeting the shortage nationwide by expanding to Denver, Atlanta, Dallas/Ft. Worth and Austin. As a member of the S&P 500, Equity Residential is focused on the acquisition, development, and management of residential properties apartments. The company aims to help reduce the housing supply deficit of 3.8 million units.3

Transit Oriented Development

Transit oriented development (TOD) is a fast-growing trend Equity Residential is pursuing. TOD is the creation of urban areas around well-functioning travel systems with the aim of improving lifestyles and reducing time spent commuting. TOD makes a lower-stress life possible without complete dependence on a car for mobility and survival. It also has a crucial place in the fight against climate change since it creates walkable communities that reduce the necessity for driving and energy consumption, as much as 85%.4

One of the most prominent examples of TOD is observed in Arlington, Virginia. For years, the area was once a collection of auto-centric communities, Arlington transformed towards sustainability and transit-oriented development, thanks to the government strategy that focused urban development within 1⁄4 to 1⁄2 mile from Arlington’s Metrorail Service stations.5

As a result, Arlington became the first recipient of the EPA’s National Award for Smart Growth Achievement for “Overall Excellence in Smart Growth” in 2002. An Equity Residential property, 2201 Pershing, Arlington, Virginia maximizes these benefits for its residents. With its proximity to the metro line and Washington, D.C., this LEED Silver certified residential property exemplifies the transit oriented development around major cities and proves the dedication of Equity Residential to sustainable development.

The Inflation Reduction Act (2022) incentivizes participation in clean energy initiatives through tax incentives, reducing the cost of technologies that will lower emissions and energy prices and encouraging investments in decarbonizing all sectors of the economy through targeted federal support of innovative climate solutions.

Transition to the Low-Carbon Economy

The consequences of climate change are stricter regulations for low-carbon transition as evident with the 2015 Paris Accord. As part of the Paris-aligned strategy, a forward-thinking real estate owner is critical as real estate is among the top three industries with highest greenhouse gas (GHG) emissions. Real estate owners who do not reduce their CO2 emissions in line with the 1.5°C Paris-aligned sectoral targets risk not meeting future market expectations and regulatory requirements.6 The 2022 Inflation Reduction Act targets to reduce overall GHG emissions by requiring clean energy sources.

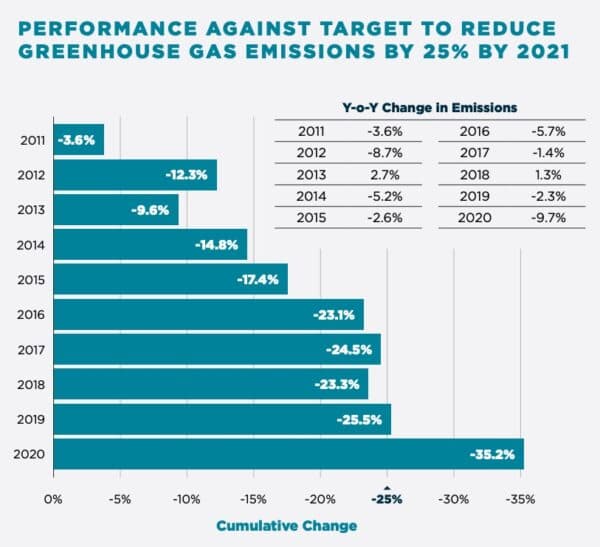

Equity Residential is preparing for emerging regulations through their commitment to science-based targets. In order to keep global warming below 1.5°C, Equity Residential set a goal to reduce GHG emission by 25% in 2011. This target was was achieved two years earlier than planned, in 2019, and a new goal was set to reduce emissions by 30% by 2030, demonstrating an increased level of sustainability dedication. With this success, Equity Residential is committed to setting a science-based targets with Science-Based Targets Initiative (SBTi); their achievements are already verified by numerous “green building” certifications, such as: LEED: Platinum, Gold, and Silver as well as BREEAM: Outstanding, and Excellent.

Green Bonds Fund Work Aligned with Sustainable Development Goals

Green financing helps companies identify investment for sustainability initiatives. Since the proceeds of green bonds are directly used for a certified climate-friendly project; they are the most emblematic and prominent green finance instrument.7 Equity Residential uses this green financing tool to expand its sustainable development. The company has issued $500 million 1.85% in green bonds due in 2031 to implement projects aligned with UN Sustainable Development Goals (SDG); particularly SDG 11 that focuses on making cities and human settlements sustainable, and SDG 13 urging for immediate action to combat climate change and its impacts. These projects are primarily focus on four categories:

Green Buildings

The company focuses on green buildings certifications in upgrading, renovating, and acquiring existing properties or building new ones. Green building qualities such as sustainable sites, water efficiency, energy, materials, waste, indoor air quality, and operations management is verified with numerous “green building” certifications, including LEED Certified, Energy Star, Built Green, CALGreen, and Home Innovation.

Renewable Energy

The green bond proceeds are utilized in development, construction, operation, and maintenance of renewable energy projects like Solar energy, Wind energy, Energy storage.25 new solar PV installations online since 2020.

Energy Efficency

Reducing energy-use is as straightforward as swapping out old technology with new. Installing LED lighting (light-emitting diode) systems and high efficiency Heating, Ventilation, and Air Conditioning (HVAC) systems.Upgrading systems enabled the company to reduce energy consumption by 18.5% in 2020.

Sustainable Water Management

Smart irrigation and other water efficient systems, water recycling/reuse systems, including graywater systems, water treatment systems that meet or exceed local water treatment standards.

1 Equity Residential. (2021) “Corporate Responsibility.” Equity Residential. https://investors.equityapartments.com/Corporate-Responsibility/Introduction/default.aspx

2 Equity Residential is 3.37% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of September 30, 2022.

3 Emily Badger and Eve Washington. (2022, July 14). “The Housing Storage Isn’t Just a Coastal Crisis Anymore.” New York Times. https://www.nytimes.com/2022/07/14/upshot/housing-shortage-us.html

4 Katherine Schaeffer. (2022, January 18). “A growing share of American say affordable housing is a major problem where they live.” Pew Research Center. https://www.pewresearch.org/fact-tank/2022/01/18/a-growing-share-of-americans-say-affordable-housing-is-a-major-problem-where-they-live.

5 Freddie Mac. (2021, May 7). “Housing Supply: A Growing Deficit.” FreddieMac. https://www.freddiemac.com/research/insight/20210507-housing-supply

6 Transit Oriented Development Institute. (n.d.). http://www.tod.org/

7 Arlington County Virginia. (n.d.) “Smart Growth.” Arlington County Virginia. https://www.arlingtonva.us/Government/Projects/Planning/Smart-Growth

8 Carbon Risk in Real Estate Monitor (CRREM). (2022, March). “Managing Transition Risk in Real Estate: Aligning to the Paris Climate Accord. CRREM. https://www.crrem.eu/wp-content/uploads/2022/04/Managing-transition-risk-in-real-estate.pdf

9 MIT Climate Portal. (2022, January 24). “Why Do Firms Issue Green Bonds?” MIT Climate Portal. https://climate.mit.edu/posts/why-do-firms-issue-green-bonds#:~:text=Green%20finance%20certification%20allows%20investors,a%20certified%20climate%2Dfriendly%20project.

Please refer to the Prospectus for full risk disclosures. All data as of September 30, 2022 and subject to change daily.