Inflation Reduction Act

May 2023

By Vert Asset Management and Aurelie Blanadet, Sustainable Finance Researcher

The Inflation Reduction Act (IRA) could easily be renamed the “Enabling the Transition to a Low Carbon Economy Act” because of its many incentives for renewable energy.

The IRA, passed in 2022, provides in excess of $500 billion in funding to fight inflation by investing in domestic energy production and manufacturing. The revenue raised to pay for the funding comes from corporate minimum tax, prescription drug pricing reform, IRS tax enforcement, and carried interest.1 The funding is in form of tax incentives, grants and loan guarantees made available through governmental departments including the Environmental Protection Agency (EPA) and the Department of Energy (DOE). 2 Many of the programs are scheduled to remain available for 8+ years. 3

It is estimated that the IRA will provide $369 billion in direct investment for energy security, reduction of carbon emissions, increase in energy innovation, and support underserved communities. 4

The IRA is also providing the DOE $1 billion in funding to help state and local governments upgrade their building codes to boost energy efficiency. This money will support the implementation, and enforcement, of the new energy efficiency codes and standards. The focus is on adopting the 2021 International Energy Conservation Code (IECC) for residential buildings and the ANSI/ASHRAE/IES Standard 90.1–2019 for commercial buildings (or similar codes with similar energy savings).5

The IRA aims to reduce in emissions by 40% by 2030. The legislation includes financial incentives for:

- retrofitting buildings with cleaner appliances and better energy standards

- introducing clean vehicle fueling sites (i.e., charging stations)

- financing carbon capture projects

- installing solar, and other clean energy projects

- creation of new renewable energy projects

The IRA certainly opens the door for more investment into decarbonization but there are also considerations for human capital. An interesting feature of the IRA is its support for a prevailing wage and the requirement for apprenticeship programs. There is also a focus on creating projects in low-income communities to help improve access to clean energy infrastructure. This is a win/win situation where tax credits for owners and suppliers leads to benefits for workers and local residents.

Key Opportunities for Real Estate Companies

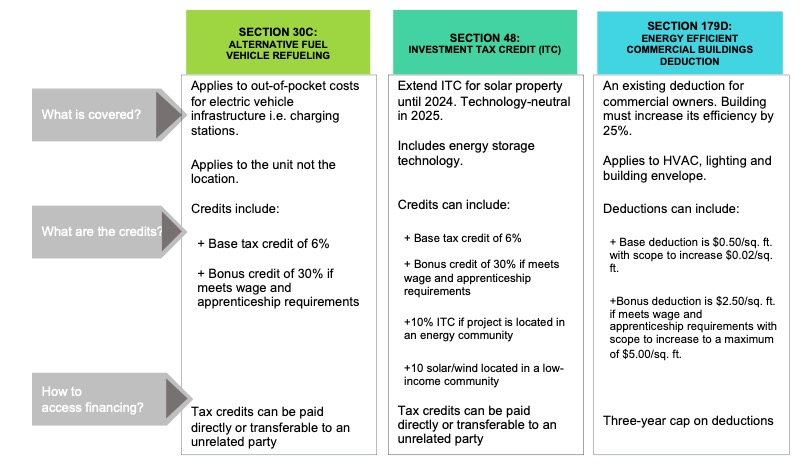

There are three key opportunities available in the IRA for REITs. Section 30C provides tax credits on Alternative Vehicle Refueling (i.e. investment in charging stations). Section 48 which extends existing Investment Tax Credits to solar properties. Section 179D gives deductions for energy efficient building renovations.

REITs pay no corporate tax so traditional investment tax credits have not been very useful. Critically, the IRA allows for the renewable energy tax credits to be transferred to third party entities in exchange for cash. This allows tax-exempt entities, including REITs, to take advantage of them, thus opening up more opportunities for direct investments in renewables.

REITS can take advantage of Section 30 and Section 48 by selling the credits or using the credits to make investing in smaller renewable energy projects profitable. “Stackable” bonus credits mean a company could potentially receive a maximum of 60% credit back on their investments into clean energy. And starting in 2023, REITs and tax-exempt buildings can also take 179D deductions, further expanding its use and value.7

How are REITs looking to use the provisions of the IRA?

These three REITs from different real estate sectors share how they are evaluating opportunities in the IRA:

UMH Properties7

Residential

UMH Properties owns and operates

135 manufactured home communities mostly along the eastern seaboard and the US southeast. UMH is focused on providing more affordable housing solutions for low and middle income Americans.

If UMH invests in community solar or installs renewable energy generation projects before 2024, UMH could benefit from the Section 48 Investment Tax Credit (ITC) which allows project owners or investors to be eligible for tax credits. Ultimately, residents could benefit from the onsite energy systems with lower utility bills.

Regency Centers8

Retail

Regency Centers is a retail REIT with over 400 shopping centers across the US.

Regency sees the biggest potential for their business is the extension of the existing renewable energy investment tax credits, and more importantly, the transferability of these tax credits.

The IRA includes incentives for the installation of EV charging stations. While Regency does not invest directly in EV charging stations, their EV partners and suppliers should be able to take advantage of these incentives. More EV charging stations can increase demand and potentially increase rents for parking spaces at Regency centers.

Iron Mountain9

Infrastructure

Iron Mountain owns data centers in 60 countries helping customers store their valuable digital information. Iron Mountain is a member of RE100 – a global corporate renewable energy initiative bringing together hundreds of businesses committed to 100% renewable electricity.

The IRA contains incentives to build offshore wind farms, solar, replace combustion vehicles with electric vehicles and build out the EV charging infrastructure. Iron Mountain stands to benefit from these provisions as furthers its goals of procuring 100% clean energy and converting their vehicle fleet to EVs.

1 McKinsey & Company (2022 October 24). “The Inflation Reduction Act: Here’s what’s in it.” McKinsey & Company. https://www.mckinsey.com/industries/public-and-social-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it

2 The White House. (2022). “The Inflation Reduction Act Guidebook.” The White House. https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/

3 Holland & Knight. (2022 August 17). “The Inflations Reduction Act: Summary of the Budget Reconciliation Act”. Holland & Knight. https://www.hklaw.com/en/insights/publications/2022/08/the-inflation-reduction-act-summary-of-the-budget-reconciliation-act

4 Holland & Knight. (2022 August 17). “The Inflations Reduction Act: Summary of the Budget Reconciliation Act”. Holland & Knight. https://www.hklaw.com/en/insights/publications/2022/08/the-inflation-reduction-act-summary-of-the-budget-reconciliation-act

5 Fabris, P. (2023 April 7). “Department of Energy makes $1 billion available for states, local governments to upgrade building codes.” Building Design + Construction Network. https://www.bdcnetwork.com/department-energy-makes-1-billion-available-states-local-governments-upgrade-building-codes

6 PwC. (October 2022). “Inflation Reduction Act: ESG provisions may provide benefits to the real estate industry.” PwC. https://www.pwc.com/us/en/tax-services/publications/insights/assets/pwc-ira-credit-provisions-may-benefit-the-real-estate-industry.pdf

7 UMH Properties is 0.14% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2023.

8 Regency Centers Corp is 1.32% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2023.

9 Iron Mountain is 2.20% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2023.

Please refer to the Prospectus for full risk disclosures. All data as of March 31, 2023 and subject to change daily.